Let’s start by setting one thing straight: this isn’t about taking away from anyone’s achievements. Building a business from scratch and managing an Amazon FBA brand isn’t easy. In fact, it’s a huge accomplishment!

We’re here to celebrate success but also to advocate for transparency. Revenue numbers, like Daz Tweed’s $80,000 with his Amazon brand Creativia, sound impressive on the surface—but without context, they can be misleading. So, let’s take a closer look at what this $80,000 revenue figure actually means, after considering costs, taxes, and some realistic calculations.

1. Daz’s Journey: From Accountant to Amazon FBA Seller

In January, Darren Campbell shared an enthusiastic post about Daz and his partner Amber. They hit $20,000 in revenue within their first 40 days of launching Creativia, a brand selling puzzle tables on Amazon. Darren wrote:

“BOOOOOOM….here we go again 💥 ANOTHER huge successful brand launch 📈... generating over $20,000 (20K) in only their first 40 days launched on Amazon 🇺🇸”

Darren framed Daz and Amber’s journey as a beacon of hope for busy parents, balancing demanding jobs and family life, aiming for financial freedom. It’s inspiring, no doubt—but $20,000 in revenue doesn’t mean $20,000 in profit, and that’s the detail that often gets lost.

Fast forward to nearly a year later, and Daz recently celebrated hitting $80,000 in revenue. In his own post, Daz reflected on his journey:

"Supplier issues, I’ve had quality issues, I’ve had shipping issues, you name it, I’ve had it. But with the help of the team, I’ve overcome every one of them… If you had told me that at the start I would have bit your hand off for it."

It’s clear that Daz has worked hard to achieve this milestone. But while $80,000 in revenue is impressive, let’s break down the costs to see what Daz’s actual take-home income might look like.

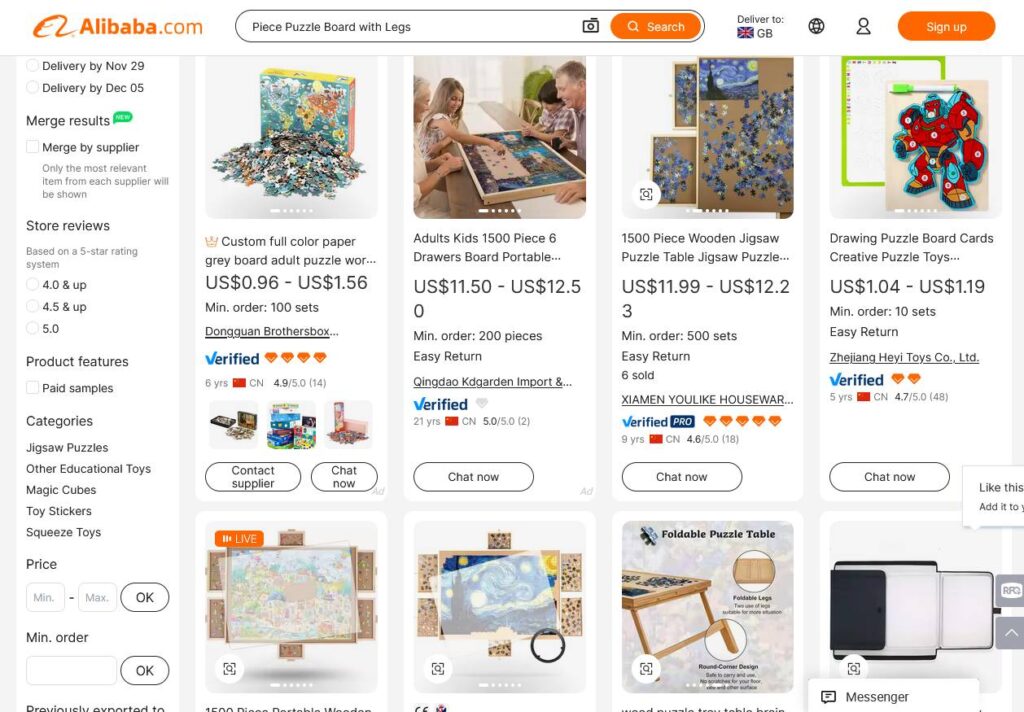

2. The Real Cost of Goods: Sourcing from Alibaba

Creativia’s puzzle table, like many Amazon FBA products, is white-labeled from Alibaba. A similar table on Alibaba typically costs about $15 per unit. Now, this is a ballpark figure—prices can vary depending on factors like order size, shipping, and quality adjustments. But for the sake of our analysis, let’s go with this $15 estimate.

So, if Daz bought each table for $15 and sold them for around $89.95 on Amazon, that’s a big markup. But remember, Amazon FBA comes with a whole suite of fees, and those add up fast.

3. Amazon FBA Fees: The Hidden Costs

When you sell on Amazon, you’re paying for more than just the product. Amazon charges fees for everything from storage to packing to shipping. Here’s a rough estimate of the FBA costs for each unit:

- Fulfillment and Referral Fees: For a product of this size, fees are likely around $10-$12 per unit.

- Storage Fees: On top of that, Amazon charges for storing inventory in their warehouses. For a bulkier item like a puzzle table, storage costs can be significant, especially if stock isn’t moving quickly.

Adding it up, let’s say each unit costs Daz around $25-$30 in Amazon fees alone. So, that big markup starts to shrink once these costs come into play.

4. Advertising: Staying Visible Costs Money

Amazon is a crowded marketplace. To stand out, most sellers—especially new brands—rely heavily on advertising. Darren often suggests that his students spend $50 to $70 a day on ads to keep their products visible. So, let’s assume Daz went with the lower end: $50 a day.

Over the course of a year, that daily ad spend adds up to $18,250. It’s necessary for staying visible on Amazon, but it’s a big chunk of change that comes straight out of profits.

5. So, What’s the Real Profit?

Now, let’s get to the real numbers. Here’s how Daz’s revenue breaks down when we factor in product costs, Amazon fees, and advertising.

Revenue: $80,000

Estimated Wholesale Cost: $15 per unit × estimated 889 units = $13,335

Amazon Fees: $25 per unit × estimated 889 units = $22,225

Advertising Cost: $18,250

Total Estimated Costs: $13,335 + $22,225 + $18,250 = $53,810

Estimated Profit Before Tax: $80,000 - $53,810 = $26,190

So, after accounting for costs, that $80,000 in revenue leaves Daz with an estimated $26,190 in profit before taxes.

6. Tax Obligations and Final Take-Home

If Daz’s Amazon business operates from Northern Ireland, he’s also subject to UK corporation tax, which is currently 19%. So, let’s take that into account:

- Post-Tax Profit Estimate: $26,190 - (19% tax) = $21,210.90

That’s what Daz might realistically take home after taxes. And if we convert that into British pounds, using an exchange rate of about 1 USD = 0.78 GBP:

- Take-Home Equivalent in GBP: $21,210.90 × 0.78 = £16,544.50

So, in terms of take-home pay, Daz’s year of hard work amounts to around £16,544.50. Again, we’re not here to knock anyone’s success—Daz has clearly put in the hours and overcome real challenges to build his business. But it’s essential to view these revenue numbers through a lens of transparency.

7. Selling the FBA Dream: The Power of Narrative

Darren’s post about Daz and Amber’s initial $20K milestone painted a heartwarming picture of a family balancing busy lives and working towards financial freedom. It’s a narrative that resonates with a lot of people who dream of quitting the 9-to-5 grind. Darren encouraged Daz and Amber to look forward to “a nice exit” for their brand within the next few years:

“I believe that they will sell their brand for a nice exit within the next 3 years through the FBABB…”

These stories can be powerful, and there’s no doubt they inspire people to join Darren’s program. But it’s important to question if these dreams align with reality. As we covered in our previous article on Josh’s journey, revenue doesn’t equal profit, and building a truly resellable brand is much harder than it might seem.

Conclusion: Why Transparency Matters

Daz’s journey with Creativia is something to be proud of, and hitting $80,000 in revenue is no small feat. But when we look beyond the surface and factor in costs, taxes, and Amazon fees, the picture changes. Revenue grabs attention, but transparency provides a clearer, more honest view of what’s involved.

For anyone considering FBA, remember that flashy revenue numbers don’t tell the whole story. Take a closer look, ask questions, and make sure you have a realistic view of the costs, challenges, and potential returns. In an industry that often celebrates revenue without showing the full breakdown, we hope this article helps shine a light on the realities of Amazon FBA.