The FBA Brand Builder promises to transform lives, teaching aspiring entrepreneurs how to build successful Amazon FBA businesses. However, as new revelations surface, the line between guidance and questionable ethics grows increasingly blurry. Darren Campbell, the program’s founder, is now facing scrutiny not just for his personal advice but also for how his team echoes that advice to clients.

Recent footage reviewed by the Belfast Telegraph—and privately shared with us—shows Campbell instructing participants on how to fill out a credit application in ways that raise ethical and legal questions.

Darren’s Advice: “Put £150k or £200k Turnover”

In the leaked video, Darren offers this detailed instruction:

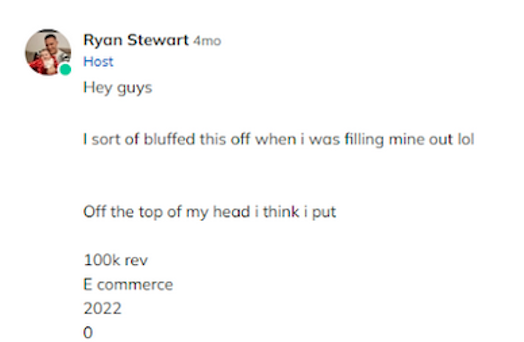

His guidance to inflate both income and turnover figures is presented as routine and critical for success. The explicit encouragement to stretch the truth left no room for doubt about the intent.

Echoes in Team Chats: Learning From the Top

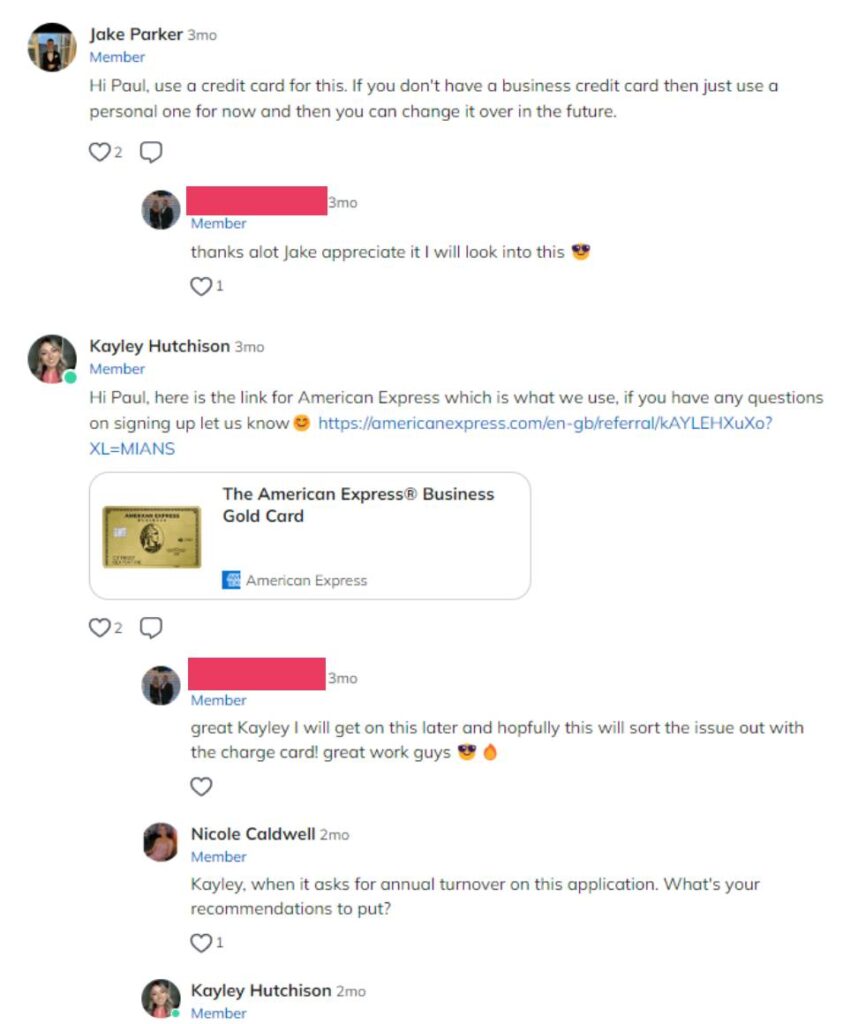

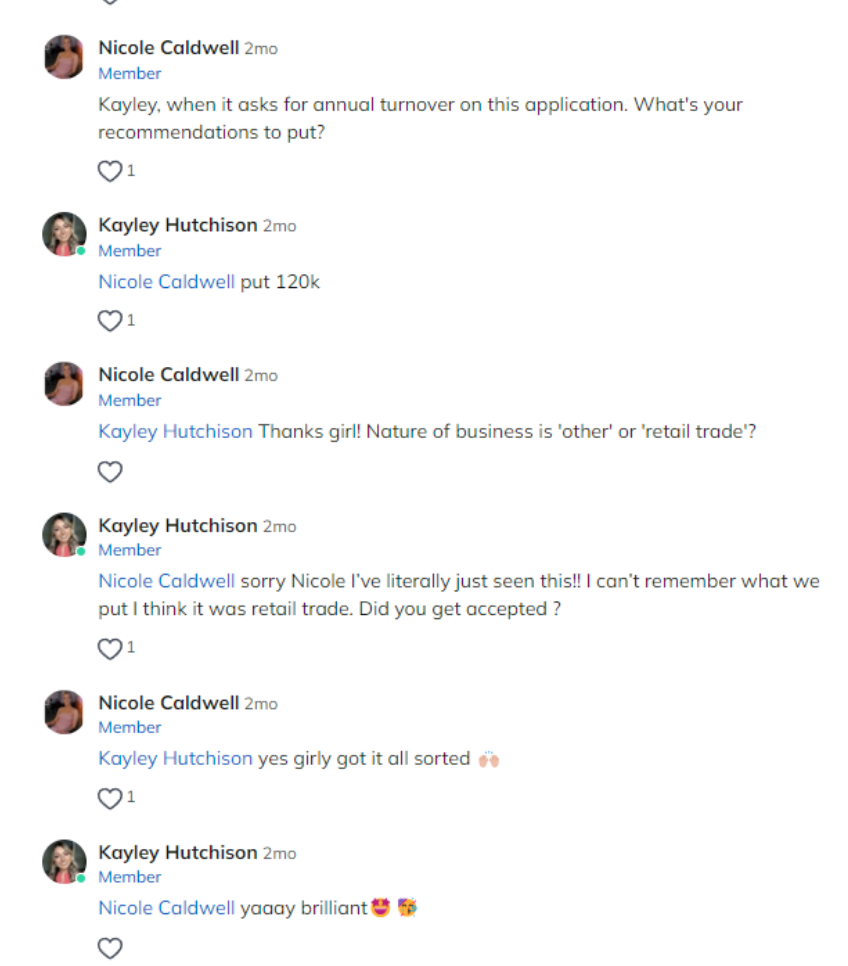

This advice hasn’t stayed confined to Darren’s seminars. Internal chats on the FBA Brand Builder’s Mighty Networks platform show team members offering eerily similar suggestions. In one instance, Kayley Hutchison, a senior member of the team, advised a client to list their annual turnover as “120k” despite the client’s business not yet being operational.

Another exchange revealed Kayley sharing a referral link to an American Express card, mirroring Darren’s emphasis on using Amex cards for their repayment flexibility. The team’s guidance feels less like mentorship and more like a copy-paste of Darren’s instructions, passing on his questionable practices to clients.

These conversations underscore a troubling dynamic: Darren’s advice is being institutionalized within the program. Instead of challenging dubious suggestions, the team perpetuates them, creating a system where clients are encouraged to prioritize success over transparency.

A Pattern of Misrepresentation

The Belfast Telegraph’s investigation further revealed concerns about clients being encouraged to lie on applications to secure loans or credit cards. In one instance, Campbell reportedly advised clients to list £150k as their expected revenue, a move echoed by his team in subsequent chats.

American Express, named by Darren as a program partner, swiftly denied any business relationship.

This revelation raises serious questions about how Darren positions himself and the program to clients. It’s not just about exaggerating figures—it’s about whether clients are being sold a dream built on shaky foundations.

The Real Cost of the Dream

The FBA Brand Builder heavily markets itself as a transformative program, claiming participants can generate passive income with minimal effort after the initial setup. However, as clients dig deeper, they’re confronted with spiraling costs. From mandatory ad spend to additional fees for PPC (pay-per-click) management, the financial demands quickly outstrip initial expectations.

The promise of an “expert team” guiding clients to success is another area that draws scrutiny. Many clients have expressed doubts about the professional experience of Darren’s staff, especially when the advice they’re receiving seems to mimic Darren’s own questionable practices. If the team’s expertise lies primarily in parroting Darren’s instructions, it raises valid concerns about the value of the £6,500 entry fee and ongoing monthly charges.

Legal and Ethical Questions: Can Contracts Be Challenged?

The contract clients sign when joining FBA Brand Builder is extensive and binding, with clauses preventing participants from criticizing the program publicly or seeking alternative guidance. However, UK contract law offers a potential avenue for challenge.

Under the law, contracts may be voidable if they were entered into based on misrepresentation. If Darren and his team’s advice—or their portrayal of the program’s success—induced clients to sign up under false pretenses, there’s a case for arguing the contract is invalid.

The Belfast Telegraph also highlighted the Financial Conduct Authority’s (FCA) position on this matter:

“You should be wary of anyone encouraging you to lie on a credit application. Doing so puts you at risk of taking on too much debt and of breaking the law.”

This stance further underlines the risks clients face, not just financially but legally, when following advice from FBA Brand Builder.

Darren’s Deflection and Legal Threats

In response to the Belfast Telegraph’s exposé, Darren issued a lengthy denial, threatening to sue for “millions” in damages. His statement framed the investigation as an attack on the program’s integrity, insisting that his guidance was being misinterpreted.

However, legal action could backfire. A lawsuit would likely bring further scrutiny to the program’s practices, potentially unearthing more evidence and client testimonials. Darren’s response, while defiant, does little to address the core concerns raised by clients and investigators alike.

Building Brands or Breaking Trust?

At its core, the FBA Brand Builder is supposed to be about empowerment and education. But when advice crosses into ethically questionable territory, and team members echo that advice without challenge, it undermines the trust clients place in the program.

For those considering signing up, the message is clear: dig deeper. Ask hard questions about the expertise of the team, the true costs involved, and the ethical boundaries of the advice being given. Success stories might be inspiring, but without transparency and accountability, they remain just that—stories.

In light of recent revelations, potential clients should weigh whether they’re signing up for genuine mentorship or a high-risk gamble with questionable ethics baked in.

Of course, we couldn’t wrap this up without mentioning Kayley’s shared American Express Business Gold Card referral link—because at FBA Brand Builder, it seems Darren and his team never miss a chance to pocket a little extra commission on the side.