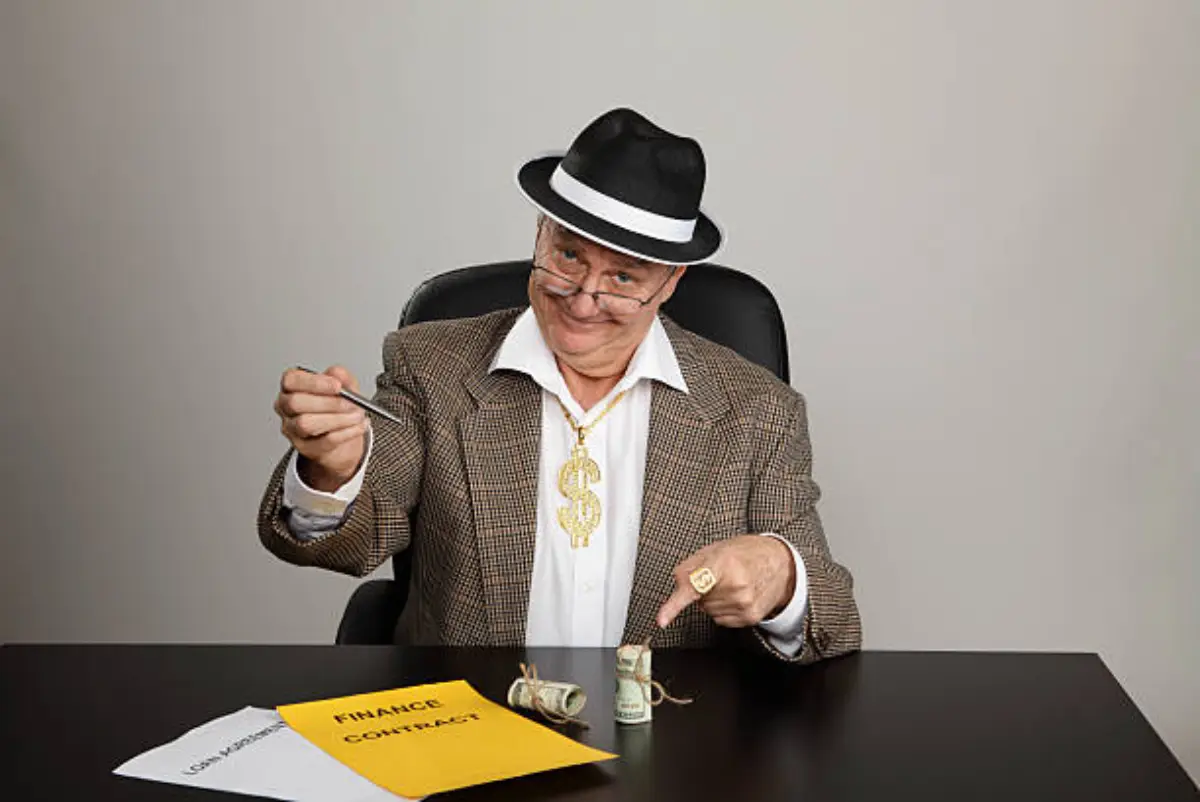

Darren Campbell’s latest move—offering “capital on demand” through a Dubai-based contact—has sparked serious concerns about financial transparency and client safety. For a program already mired in allegations of mismanagement and questionable advice, this new funding option appears to be yet another risky tactic designed to keep clients spending.

At first glance, the offer might seem like a lifeline for struggling FBA Brand Builder participants. But the truth is far murkier. This setup not only ties into Darren’s long-standing Dubai connection but also raises critical questions about client risk, program motives, and the broader consequences of unchecked lending.

Wayflyer, there was a little bit of a sticking point with a lot of our brands and what they needed. Not to say we won't work with them in the future, but I want to be resourceful and try and work for you guys to get capital ASAP so you can grow your business and brand quicker.

So we're heading to Dubai next week to meet with my finance and wealth manager, who's Zamer. He has just secured approval to become his own bank, which is fucking huge, which means for many of you, there’s potentially capital on demand to fuel brand growth through our partnership. If I need it on, for instance, we'll set down how that's going to obviously work.

No more waiting. If you need it to sell faster, have more products, more stock of luxury products—we're going to make it fucking happen.

A Dubai-Based Bank? Why It’s Raising Eyebrows

Dubai, long known for its tax advantages and lack of financial disclosure, is becoming a central piece in Darren Campbell’s operations. His frequent trips to the region and rumored financial ties have already raised speculation about his program’s transparency. Now, with this "capital on demand" option reportedly managed by a Dubai-based associate, the puzzle starts to fit together in troubling ways.

This isn’t a typical lending setup. Clients desperate to make their Amazon businesses work are being pointed toward a high-risk source in Dubai. Unlike traditional UK or EU-based lending, Dubai’s financial regulations are less stringent, creating a perfect environment for a loan scheme that lacks client protections.

High Risks, Minimal Protections

For clients, this arrangement could have severe consequences:

- Ballooning Debt: Struggling clients already encouraged to max out credit cards or take out personal loans now face the added pressure of a Dubai-based lender. This could spiral them further into financial insecurity.

- Opaque Terms: What are the terms and conditions of this “capital on demand”? Clients reportedly aren’t given clear answers, raising questions about interest rates, repayment schedules, and consequences for defaulting.

- Limited Recourse: Dubai’s financial system is notoriously difficult to navigate for those outside the region. If a loan agreement goes south, clients may find themselves with no legal recourse.

Why Dubai? Protecting Darren, Not Clients

As we reported earlier, Darren’s financial connections to Dubai aren’t just a coincidence. His frequent trips could fulfill residency requirements for maintaining a Dubai-registered business, which offers tax advantages and shields income from public scrutiny.

This setup also creates significant hurdles for clients seeking refunds or legal action. Funds held in Dubai may be out of reach for UK regulators or courts, making it harder for clients to recover losses—even with a court order in their favor.

The “capital on demand” offering fits neatly into this narrative. By routing financial transactions through Dubai, Darren gains an extra layer of protection, ensuring his assets remain secure while clients shoulder all the risk.

A Troubling Pattern of Financial Exploitation

Darren’s new funding option isn’t an isolated case—it’s part of a larger trend. From questionable advice on AMEX applications to encouraging personal loans, his program consistently prioritizes client spending over financial security.

In a video shared with clients, Darren described the new lending option as a way to help participants succeed. He claimed:

"He has just got secured approval to become his own bank, which is fucking huge, which means for many of you, which potentially have capital on demand and fuel brands growth through me and this partnership."

While the pitch may sound appealing, the reality is far riskier. Loans are rarely “instant” without steep interest rates or hidden fees, and the lack of transparency around this offering only amplifies the concern.

Financial Freedom or Lifelong Debt?

For struggling clients, the allure of quick capital can be hard to resist—especially when paired with Darren’s messaging about financial independence. But the truth is stark: these loans could lead to crippling debt.

Darren’s broader goal seems clear. By offering a Dubai-based funding option, he ensures clients stay tied to his program, continually spending on monthly retainers and other services. Meanwhile, the clients—many already financially stretched—are left holding the bag.

A Reminder of the AMEX Scandal

This isn’t Darren’s first brush with questionable financial advice. As reported by the Belfast Telegraph, Darren was caught encouraging clients to inflate their income on AMEX applications. He told one client:

“Put in £36k, £37k, £38k... Put in £150k or £200k [for projected turnover]. I’d be very, very shocked if you didn’t get it.”

The AMEX scandal highlighted Darren’s disregard for financial ethics, putting clients at risk of fraud charges and financial ruin. This new Dubai “bank” appears to be a continuation of the same reckless approach.

Tying It All Together

Darren Campbell’s FBA Brand Builder program has long marketed itself as a pathway to financial freedom. But the reality for many clients has been mounting debt, poor advice, and broken promises. The introduction of “capital on demand” through a Dubai-based lender raises even more red flags.

- Why aren’t the loan terms clearly disclosed?

- How does this benefit clients instead of trapping them in a cycle of debt?

- What role does Dubai play in shielding Darren from accountability?

Darren Campbell’s Crumbling Empire

As more clients come forward and the media scrutiny intensifies, Darren’s house of cards appears increasingly unstable. The Dubai “bank” is just the latest in a string of questionable practices that put profits over people.

For potential clients, the message is clear: think twice before investing in FBA Brand Builder. Behind the flashy promises lies a system that thrives on client vulnerability while protecting Darren’s bottom line. If you’re considering this program, ask yourself: whose financial freedom is it really securing?