Darren Campbell’s latest promotion of Fast Ambition, his supposed Amazon FBA “Brand Builder of the Year,” paints a picture of spectacular financial success. According to Campbell, Fast Ambition, founded by his earliest students Ryan Stewart and Ryan Tweed, is generating hundreds of thousands in revenue, quickly approaching the million-dollar mark.

But as we dig into publicly available data from Companies House, a glaring question emerges: Where’s the money?

The Bold Claims vs. The Company Records

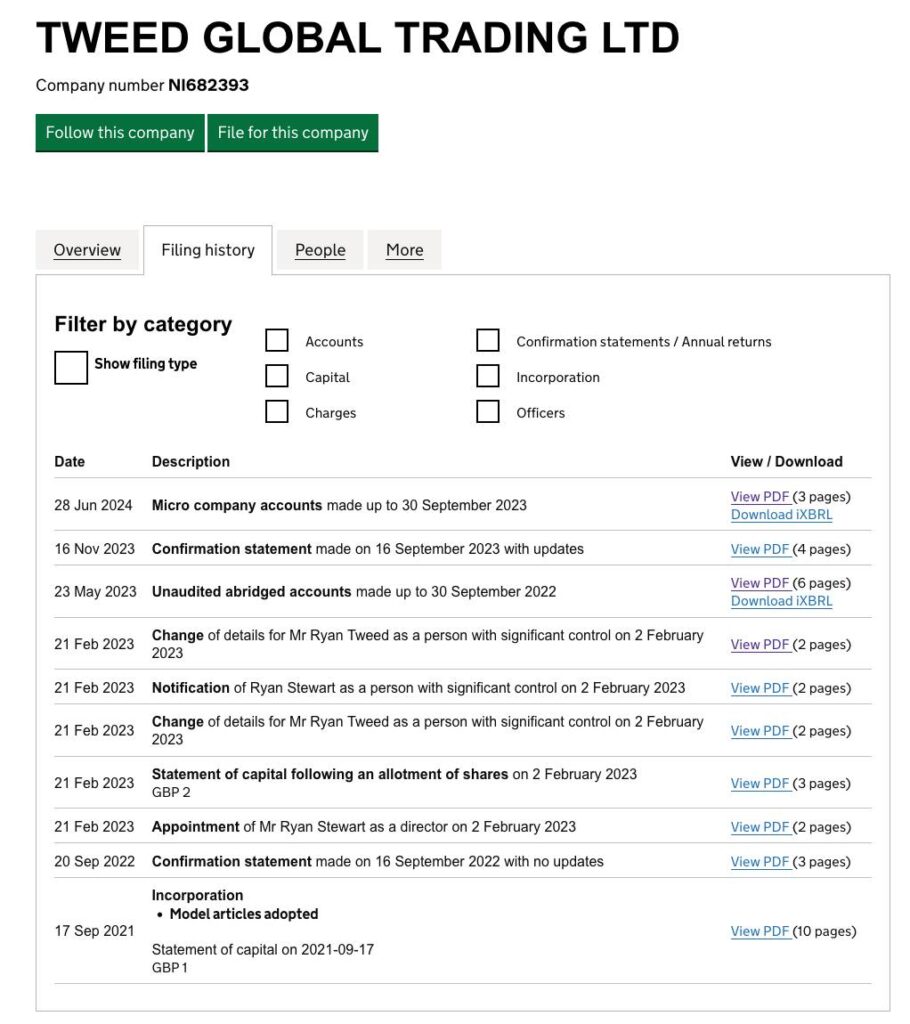

Campbell frequently posts eye-catching screenshots of Amazon Seller dashboards, showing impressive sales numbers like $70,000 in a single month. In one post, he claimed the two founders have generated over $550,000 in sales within 16 months. These figures suggest Fast Ambition is operating at a high velocity, moving thousands of units and raking in revenue with ease. But when we cross-reference these claims with the financial filings for Fast Ambition’s registered company, Tweed Global Trading Ltd, the story gets murky.

For a company allegedly making over half a million dollars in a little over a year, the 2022 and 2023 financial filings don’t align. Here’s what we can see:

- 2022 Financials: According to the publicly available filings, Tweed Global Trading Ltd reported net liabilities of £8,867 for the year ending September 30, 2022. There’s no indication of large cash flow, significant assets, or substantial profits. In fact, the company’s financial position at this time was negative.

- 2023 Financials: In the filings for the year ending September 30, 2023, the situation improved somewhat, with net assets reaching £15,049. However, even this figure is far from what you’d expect for a brand reportedly generating hundreds of thousands in revenue on Amazon. If the business was bringing in $70,000 a month, as Campbell’s posts suggest, it’s hard to understand why the company’s recorded net assets and overall financial standing appear so modest.

What’s Missing from the Financial Picture?

If Fast Ambition truly generated over $550,000 in revenue within 16 months, as Campbell claims, why don’t the financial statements reflect this? A business pulling in those kinds of figures would typically show substantial growth in assets, reinvestments, and profit on its books. Yet, the numbers filed with Companies House paint a picture of a small, struggling business with relatively low financial activity.

Possible explanations could include:

- High Operating Costs: One possibility is that Fast Ambition’s operational costs are so high that they’re wiping out any revenue. However, Campbell’s promotional materials and posts make no mention of heavy expenses eating into profits. If Fast Ambition’s margins were that slim, it would challenge the idea that this is a scalable, profitable business model.

- Discrepancies in Reporting: Another question is whether the revenue figures presented in Campbell’s social media posts are accurate. It’s not uncommon for promotional figures to focus on gross sales without factoring in returns, refunds, or other deductions. If the “$70,000” screenshots only show gross sales without accounting for net profit or expenses, the reality of Fast Ambition’s profitability may be far less rosy.

- Inflated Claims: Given the vast difference between Campbell’s claims and the legally reported figures, there’s a possibility that the revenue numbers he shares on social media are exaggerated or selectively chosen. Without clear documentation or detailed breakdowns, it’s difficult to verify whether these numbers reflect sustained business activity or isolated spikes in sales.

Legal Implications of Inconsistent Reporting

It’s worth noting that under UK law, companies are required to provide accurate and truthful financial information in their filings. Misrepresenting financials in legally binding documents like Companies House filings can have serious repercussions, including penalties and legal action. If Fast Ambition is, in fact, making the level of revenue Campbell claims, its filings would need to reflect this.

Moreover, the inconsistency between public claims and official records raises transparency concerns. Potential recruits to Campbell’s FBA Brand Builder program deserve to know if they’re being presented with a realistic image of what success looks like. If Campbell’s marketing material shows revenue figures that don’t align with official filings, it may be misleading those who consider joining his program.

The Questionable Success Story of Fast Ambition

The discrepancy between Campbell’s public statements and Tweed Global Trading Ltd’s financial filings calls into question the credibility of Fast Ambition’s success. Campbell frames this business as a life-changing venture that took two ordinary people from factory jobs to entrepreneurial freedom. Yet the official financial data doesn’t support the idea of a thriving, high-revenue business.

For anyone considering investing in an FBA program based on Fast Ambition’s story, this is a critical red flag. Authentic success stories typically come with transparency, showing both the highs and the lows, the revenue and the costs. Here, we’re shown a glamorous narrative but left with far more questions than answers.

A Reminder to Approach with Caution

When it comes to e-commerce education, the promise of financial freedom is enticing, but it’s essential to do your due diligence. Campbell’s story of Fast Ambition might sound inspiring, but the lack of corroborating evidence in their official financial records suggests a need for caution. If Fast Ambition’s success is as substantial as Campbell claims, it should be reflected in legally documented data. Until that happens, potential recruits should proceed carefully and demand transparency.

For those looking to build their own Amazon brand, it’s wise to remember: if something sounds too good to be true, it usually is. Look for mentors who offer a realistic picture of the challenges, expenses, and true profits of running an Amazon business, rather than relying on high-level revenue claims with no verifiable backing.