Once you’ve invested £6,500 in Darren Campbell’s FBA Brand Builder program and followed the eight-stage process, you’d expect to have most of the essentials covered. But when it comes to accounting and bookkeeping, clients are pushed toward yet another expense: Richard Ferson of FFC Bookkeeping Limited, at a cost of £75 per month.

This fee supposedly covers services like general bookkeeping, VAT return submissions, annual accounts, and tax returns. But how often are these tasks actually needed—and does it really justify paying a monthly retainer? Let’s break it down.

What’s Included in the £75?

Richard’s service list includes:

- General Bookkeeping: Keeping your business’s finances in order.

- VAT Return Submissions: Necessary for VAT-registered businesses in Northern Ireland, submitted quarterly.

- Annual Accounts: These are filed once a year with Companies House, not something that requires continuous monthly work.

- Corporation Tax Returns: Like annual accounts, this is submitted annually to HMRC.

Given the frequency of these tasks, it’s worth questioning whether clients truly need to pay £75 every single month for services that aren’t ongoing.

Are You Overpaying?

For VAT-registered businesses, tax returns are submitted quarterly—just four times a year. While bookkeeping might require more regular attention, it’s doubtful that submitting annual accounts or corporation tax returns justifies a monthly fee. These are tasks that happen once a year, meaning you’re likely paying for months where no significant accounting work is being done.

It’s also worth noting that many small businesses in Northern Ireland opt for pay-as-you-go accounting services or even use software like QuickBooks, Xero, or FreeAgent to manage these tasks independently, often at a fraction of the cost.

Is This Truly Independent Advice?

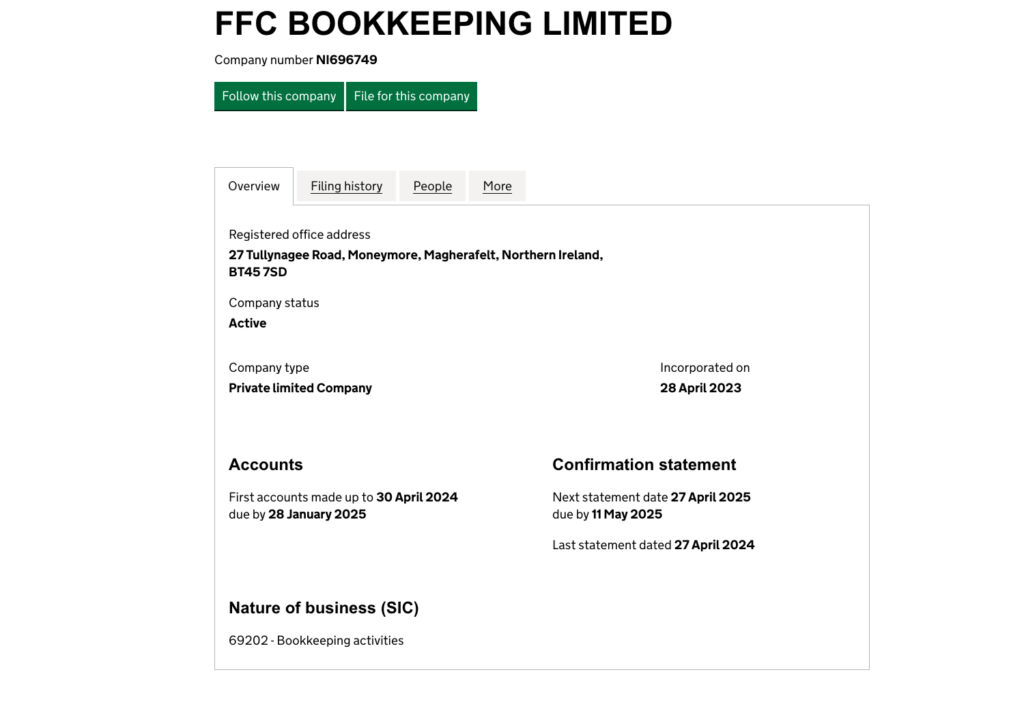

One of the biggest concerns here is the connection between FFC Bookkeeping Limited and Darren Campbell’s network. Darren himself was a director of FFC until his resignation in August 2024, and another director, Matt Florida, is actively involved with FBA Brand Builder. This raises a critical question: is this really an independent accounting service, or just another extension of Darren’s ecosystem designed to funnel more money back to him?

From the £150-a-month Growth Programme to recommended services like FBA Studio and now accounting, clients are constantly encouraged to spend more with Darren’s network. For a program that claims to provide full mentorship and support, it’s hard not to feel like these extra costs should have been disclosed upfront—or even included in the original fee.

Do You Even Need Their Accountant?

The truth is, many of the services Richard provides can be handled in other, more cost-effective ways:

- Bookkeeping: Software like QuickBooks or Xero can handle this for as little as £10-£20 a month.

- VAT Returns: These are required quarterly, so you could hire an accountant for one-off submissions instead of paying a monthly retainer.

- Annual Accounts and Corporation Tax: These are yearly tasks and don’t require ongoing monthly fees.

By choosing your own accountant or using software, you can likely save money and maintain more control over your business.

Another Cost, Another Question

Why aren’t these services included in the £6,500 fee for the FBA Brand Builder program? Accounting and bookkeeping are essential for running an Amazon FBA business, yet clients are left to pay extra or fend for themselves. When everything from accounting to PPC management seems to funnel back to Darren’s network, it raises serious questions about transparency and whether clients are being encouraged to spend unnecessarily.

If you’re considering FBA Brand Builder, be prepared for these added costs—and consider whether the recommended “solutions” are truly in your best interest. As always, do your research, ask tough questions, and make sure you’re not paying more than you need to.