U.S. President Donald Trump’s recent announcement of a possible 10% tariff on Chinese-made goods, set to take effect on February 1, 2025, could send shockwaves through global trade. For FBABB clients—many of whom depend on sourcing products from China to sell on Amazon U.S.—the impact could be massive and potentially devastating. But what exactly does this tariff mean for their businesses, and how could it affect the Amazon FBA model? Let’s break it down.

How Tariffs Work in Simple Terms

A tariff is essentially a tax placed on imported goods. In this case, it means that any product sourced from China and shipped to the U.S. will have an extra 10% cost tacked onto its total price. To put that into perspective, here’s an example:

- Before the Tariff: If you purchase a product for $10 from a Chinese manufacturer, your cost is $10.

- After the Tariff: With a 10% tariff, the same product will now cost $11 ($10 + 10%).

While this might not sound like much, for Amazon FBA sellers working with thin profit margins, this increase can be the difference between profit and loss.

What Does This Mean for FBABB Clients?

FBABB clients are already navigating a high-cost, low-margin landscape thanks to the program’s structure and the realities of the Amazon FBA model. Throwing a 10% tariff into the mix adds several new hurdles:

- Increased Product Costs: FBABB’s new program, launching this week, introduces lower-cost product tiers, moving away from their previous focus on $100+ items. With products now priced between $60 and $99, a 10% tariff further compresses already tight profit margins. In Amazon’s highly competitive marketplace, raising prices to absorb these added costs is often not an option, leaving clients with even less room for profitability.

- Lower Profit Margins: Imagine your product’s profit margin is 15%. A 10% tariff could slash that to just 5%—or even wipe it out entirely—once you account for Amazon fees, PPC advertising, and other expenses.

- Stock Management Risks: The additional cost might force clients to reduce order quantities to save money, leading to potential stockouts. This goes against FBABB’s own advice that stockouts kill organic rankings on Amazon, further jeopardizing sales.

- Strained Cash Flow: FBABB clients are already juggling various costs, from PPC campaigns to program fees. A 10% tariff adds another financial burden, potentially leaving little room to reinvest in scaling their brands.

The Larger Implications for FBABB Clients

Many FBABB clients are already questioning the program’s viability after uncovering hidden costs like PPC advertising and software fees. The addition of tariffs creates yet another roadblock, making profitability an even steeper climb. Here’s how this tariff could specifically affect FBABB clients:

- Reliance on Chinese Manufacturing: FBABB heavily encourages sourcing from China as the most cost-effective option. Shifting to alternative suppliers in countries like Vietnam or India isn’t a quick fix—higher production costs and logistical complexities make diversification challenging.

- Revenue vs. Profit Disconnect: FBABB’s marketing focuses on impressive revenue figures but rarely highlights actual profit. A 10% tariff brings this issue into sharper focus, as shrinking margins expose just how misleading those revenue claims really are.

- Unrealistic Scaling Goals: Darren Campbell’s promises of “financial freedom” and six-figure brands feel increasingly out of reach. The added expense and complexity from tariffs make scaling an Amazon FBA brand even more costly and time-consuming than FBABB clients were led to believe.

FBABB Clients Begin to Question Trump’s Tariffs

In the FBABB Mighty Networks community today, clients have started raising concerns about how Trump’s proposed 10% tariff on Chinese imports could impact their businesses. One client, Stephen, specifically asked about adjusting target prices to account for the potential tariff, particularly for those who are close to launching their products.

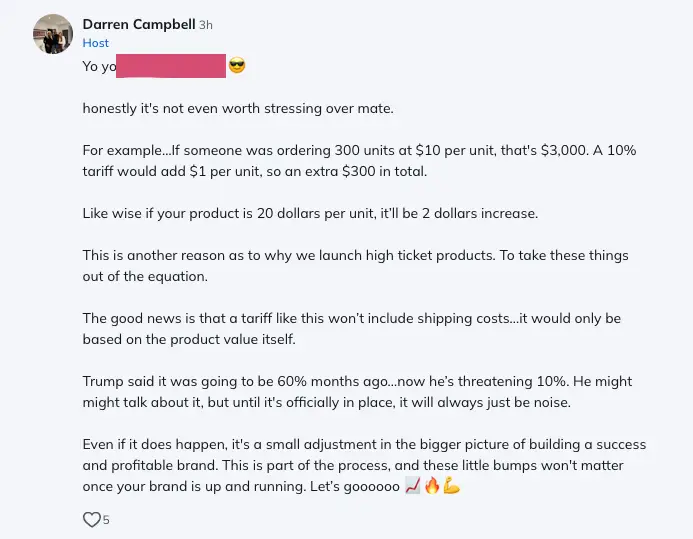

Jake Parker, a member of the FBABB team, reassured Stephen, pointing out that the language in the news—words like “threaten” and “consider”—indicated the tariff wasn’t yet confirmed. He suggested that suppliers might find ways to navigate around the tariffs and claimed any impact likely wouldn’t hit until clients were placing their second orders.

Darren Campbell, however, struck a much more dismissive tone. He framed the tariff as a minor inconvenience, explaining that for a $10 unit cost, a 10% tariff would add just $1 per unit—downplaying the overall financial strain. Darren claimed such costs could be easily absorbed by “high-ticket products” and described these adjustments as a normal part of building a brand. Labeling the tariff as “noise,” he assured clients it “won’t matter” once their brands are properly established.

While this advice might sound optimistic, it glosses over the genuine concerns of FBABB clients. Many are already operating on razor-thin margins due to the program’s high fees and other unexpected costs. By downplaying the financial impact and offering no practical strategies for dealing with the tariffs, the FBABB team risks leaving clients unprepared for what could be a significant challenge to their profitability.

The End of the Amazon FBA Business Model?

The Amazon FBA model, once a go-to for aspiring entrepreneurs, is quickly losing its appeal in 2025. Tariffs are just the latest hit to an already shaky system. Here’s why:

- Rising Costs Across the Board: Tariffs add to an already growing list of expenses, including higher Amazon fees, rising storage costs, and ever-increasing advertising expenses, leaving sellers with razor-thin margins.

- Over-Saturated Marketplace: Thousands of similar products make it harder than ever to stand out, let alone remain profitable.

- Shifting Consumer Behavior: U.S. customers are becoming more price-sensitive, making it nearly impossible to offset tariff costs by raising prices.

For FBABB clients, these combined pressures make the path to profitability steeper than ever. Competing against larger, more established

Next Steps for FBABB Clients

With the proposed tariffs creating major challenges, FBABB clients need to act fast to safeguard their businesses. Here are some practical steps to take:

- Reevaluate Product Viability: Assess how a 10% tariff will impact your product costs and decide if your current margins can handle the hit.

- Explore Alternative Sourcing: While shifting away from China can be tough, looking into manufacturers in countries like Vietnam, India, or Mexico could help reduce reliance on Chinese imports.

- Adjust Your Pricing Strategy: Research your market to see if small price increases are possible without significantly affecting your sales.

- Connect with the Community: Engage with other FBABB clients to exchange strategies and insights. Collaborating could lead to creative solutions for navigating the challenges ahead.

- Diversify Your Revenue Streams: Look into expanding your product lineup or selling in other markets to reduce dependence on U.S. sales and lessen the tariff’s impact.

A Wake-Up Call for FBABB Clients

Trump’s tariffs are a harsh reminder of just how fragile the Amazon FBA model really is. For FBABB clients, many already dealing with steep costs and minimal support, this policy could be the breaking point that forces a serious rethink about staying in the program. The dream of financial freedom feels further out of reach, making it essential for clients to evaluate whether this model still aligns with their goals.

Amazon FBA has always been tough, but in 2025, the landscape is shifting faster than ever. FBABB clients must adapt quickly to survive—or risk being left behind in a system that’s no longer working.