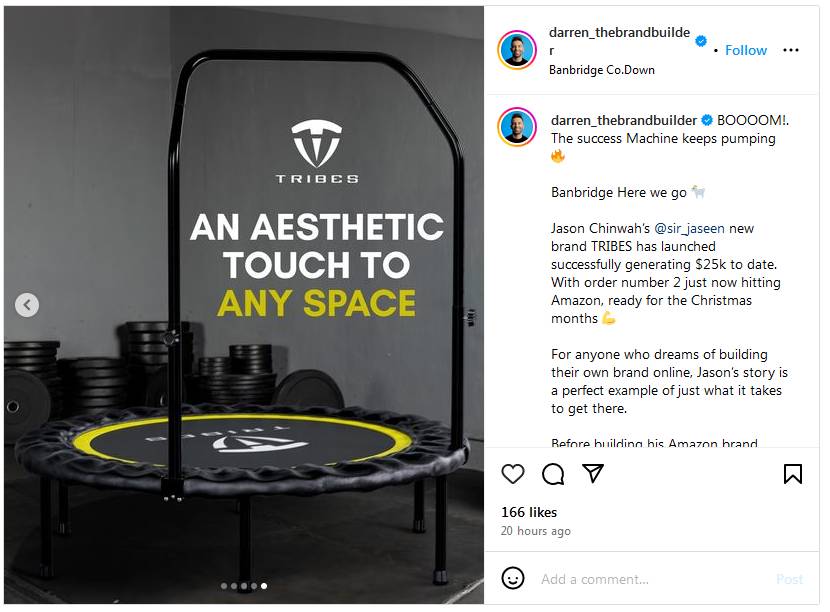

First off, let’s give Jason some props—launching a new brand on Amazon isn’t a walk in the park. He’s already hit $25,000 in revenue with his mini-trampoline fitness brand, TRIBES, which is a pretty big deal. Darren Campbell (@darren_thebrandbuilder) even highlighted Jason’s success on social media, celebrating the milestone. But if you’re familiar with running an FBA business, you know revenue alone doesn’t tell the whole story.

To get a sense of what Jason’s really pocketing, we’d have to dig into all those extra costs—like sourcing products, Amazon fees, taxes, and of course, advertising.

1. TRIBES: Jason’s Path to $25K in Revenue

Darren highlighted Jason’s persistence—this wasn’t a smooth ride to success. Jason faced several setbacks, including a failed dropshipping business and months of product compliance headaches. Now, he’s selling fitness trampolines under the TRIBES brand on Amazon, and he’s hit that $25K mark. But let’s unpack what it took to get there financially.

2. Product Costs: The Real Expense of Sourcing TRIBES

So, let’s talk about costs. Based on research, a similar trampoline to Jason’s can be found on Alibaba for about $20 per unit. Since TRIBES is priced at $89.95 on Amazon, Jason would have sold around 278 units to reach $25,000 in revenue.

With a wholesale cost of $20, his estimated product costs add up to:

- Product Cost Estimate: $20 × 278 = $5,560

This is one of the biggest chunks eating into that revenue, right off the bat.

3. Amazon FBA Fees: The Price of Convenience

Amazon’s FBA service handles storage, packaging, and shipping, which is super convenient but comes with a cost. For a product of this size, Jason’s likely paying around $11 per unit in FBA fees. That means:

- Amazon FBA Fees: $11 × 278 = $3,058

These fees are part of what makes FBA attractive for many sellers, but they do take a decent bite out of profits.

4. Advertising Costs: A Necessary Investment

To stand out on Amazon, especially as a new brand, advertising is key. While we don’t know exactly how much Jason has spent on ads—since we don’t have a confirmed launch date—we can estimate. Darren suggests his students set aside $50 to $70 per day for ads. For the sake of an estimate, we’ll assume Jason’s spent around $1,500 on ads to build momentum and get visibility.

5. Profit Breakdown: What’s Left After the Costs?

Now that we have these estimated expenses, let’s see what Jason’s actual earnings might look like:

Revenue: $25,000

Product Costs: $5,560

Amazon FBA Fees: $3,058

Estimated Advertising Costs: $1,500

Total Estimated Costs: $10,118

Estimated Profit Before Tax: $25,000 - $10,118 = $14,882

So, from the initial $25K, we’re looking at a pre-tax profit of about $14,882. Not bad, but there’s more to consider.

6. Taxes: The Final Cut

Since Jason operates from Northern Ireland, his profits are subject to UK corporation tax at 19%. After tax, the take-home amount looks like this:

- Post-Tax Profit Estimate: $14,882 - (19% tax) = $12,055.42

And if we convert this to pounds at an approximate exchange rate of 1 USD = 0.78 GBP:

- Take-Home Equivalent in GBP: $12,055.42 × 0.78 = £9,403.23

So, after taxes, Jason’s estimated take-home profit sits at around £9,403.

7. Revenue vs. Profit: The Full Picture

Darren’s post celebrating Jason’s revenue milestone is inspirational, but it’s a good reminder that revenue is just the start. Once you account for product costs, fees, ad spend, and taxes, the take-home figure is significantly lower than that shiny revenue number. This is the part of the story that often gets missed.

TL;DR: A Reminder for Future Amazon Sellers

Jason’s $25,000 revenue milestone is something to be proud of, no question. But revenue alone doesn’t tell you the whole story—there’s a lot that goes into making an Amazon business profitable, and what you keep after all the expenses is what really matters.

For those considering an Amazon FBA business, it’s important to be aware of all the factors involved, beyond just the top-line revenue. Knowing the actual take-home potential can help you set realistic expectations and make informed decisions about your business journey.