Darren Campbell’s FBA Brand Builder (FBABB) program is back waffling on social media with another bold claim: Fast Ambition, led by Ryan Stewart and Ryan Tweed, has supposedly become its first “million-dollar brand.” Darren shared the announcement on Instagram, boasting impressive figures like $1.05 million in revenue, nearly $200,000 in net profit, and a $400,000 brand valuation. On the surface, it’s a story of success worth celebrating—but dig a little deeper, and cracks begin to show.

As with many of Darren’s claims, these numbers don’t hold up under scrutiny. By analyzing publicly available data, Fast Ambition’s actual performance, and the typical economics of Amazon FBA businesses, a very different picture emerges.

In fact, even Darren’s earlier claims about Fast Ambition—addressed in two of our previous articles—were riddled with inconsistencies. This deep dive takes another look at those issues, dissects the numbers, and reveals the reality behind Fast Ambition’s so-called “success.”

The Claims vs. Reality

Darren’s announcement shared these key highlights from Fast Ambition’s two-year journey (October 2022 – December 2024):

- $1,051,802.96 in total revenue.

- Nearly $200,000 in net profit.

- $500,000 paid into their bank account.

- A brand valuation of $400,000.

- Two products generating consistent sales.

On the surface, these numbers seem impressive. Darren even proclaimed:

“It takes someone working a £20K-a-year job 20 YEARS to achieve what the Ryans have now done in just 24 months.”

But let’s break these numbers down using verified methods.

Revenue vs. Net Profit: A Closer Look

While $1.05 million in revenue sounds incredible, the reality of Amazon FBA is far more complex. Fast Ambition’s reported net profit of $176,687.26 reveals the real story:

Converting to Sterling (£)

Using today’s exchange rate ($1 = £0.82), the figures translate to:

- Total revenue: £861,480.

- Net profit: £144,083.

- Profit split per founder: £144,083 ÷ 2 = £72,041 over two years.

Monthly and Annual Earnings

When spread across 26 months (November 2022 – December 2024):

- Monthly profit per founder: £2,771.

- Annualized income: £33,252.

Contextualizing These Earnings

Fast Ambition’s income paints a far less glamorous picture than Darren’s claims of it being “life-changing.” Their earnings fall just below Northern Ireland’s median annual salary of £34,400 (2024). After accounting for taxes—roughly 20% for income under £50,270—each founder would take home about £26,600 annually. These modest earnings hardly align with the bold assertion that their business is worth £400,000.

Darren’s Inflated Brand Valuation

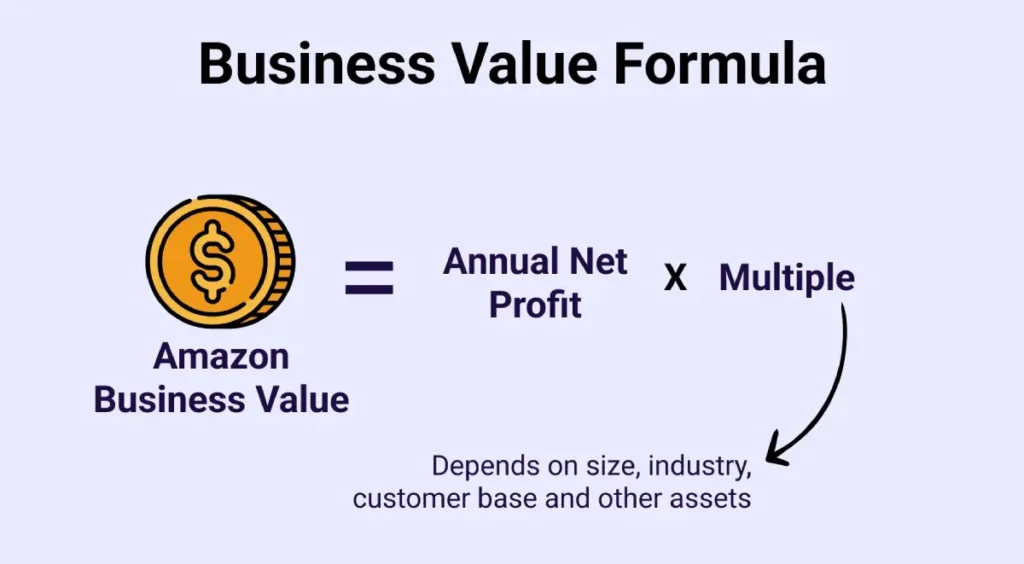

One of the most questionable aspects of Darren’s announcement is his claim that Fast Ambition is valued at $400,000 (£328,000). In reality, Amazon FBA brand valuations are generally based on a multiple of 2x to 3x the annual net profit. Let’s break it down:

- Annual net profit (total): £144,083 ÷ 2 years = £72,041.

- Realistic valuation range:

- 2x: £72,041 × 2 = £144,083.

- 3x: £72,041 × 3 = £216,123.

Even using the higher end of the multiplier range, Fast Ambition’s actual valuation is closer to £216,123—far below Darren’s claim of £328,000. This discrepancy raises questions about the credibility of Darren’s financial narratives.

Lessons from Previous Articles

This isn’t the first time Darren’s claims about Fast Ambition have been debunked. Let’s revisit our earlier findings:

In November 2024, we uncovered significant discrepancies between Darren’s revenue claims and Tweed Global Trading Ltd’s financial filings:

- 2022 Financials: The company reported net liabilities of £8,867.

- 2023 Financials: Net assets improved to £15,049, but there was no evidence of substantial profits or significant cash flow.

We questioned whether Fast Ambition’s operational costs, revenue deductions, or exaggerated claims were obscuring the reality of their financial health. These inconsistencies persist in Darren’s latest announcement.

In October 2024, we highlighted Fast Ambition’s low Amazon review counts, weak online presence, and minimal social media engagement—metrics that don’t align with a thriving million-dollar brand:

- Product reviews: Just 87 combined reviews across two products.

- Website traffic: Approximately 1,276 monthly visitors.

- Community size: A private community with only seven members.

These data points suggest Fast Ambition is more of a modest startup than a booming e-commerce powerhouse.

Fast Ambition’s Limited Brand Presence

Successful brands typically generate organic traffic, build active social media communities, and foster customer loyalty. Fast Ambition, however, struggles in all these areas:

- Search Behavior: Most buyers on Amazon search for products by price or category, not specific brand names like “Fast Ambition.”

- No Independent Identity: Fast Ambition doesn’t have a distinct online presence outside of Amazon.

- Minimal Engagement: Their Instagram account has only 2,569 followers, while their TikTok lags even further behind with just 189 followers.

Without a strong independent brand or loyal audience, Fast Ambition is entirely reliant on Amazon—a risky and unstable position for any business claiming long-term success.

What Darren’s Post Doesn’t Tell You

Darren’s announcement highlights Fast Ambition’s revenue, but it conveniently leaves out key details that paint a less flattering picture:

- Returns and Refunds: With 439 refunds, the actual revenue is likely lower than the figures Darren shared.

- Advertising Costs: Advertising expenses total £126,852 ($154,696), eating into profitability and highlighting how much the brand depends on paid promotion.

- Operational Risks: The business relies almost entirely on Amazon’s platform, leaving it highly vulnerable to policy changes, market shifts, or increased competition.

These omissions reveal a much riskier and less profitable reality than Darren’s celebratory post suggests.

A Reality Check for FBABB Clients

Fast Ambition’s journey is undoubtedly a testament to hard work, but Darren Campbell’s portrayal skews the reality of Amazon FBA success. Here’s what potential clients need to consider:

- Modest Earnings: Despite generating “million-dollar” sales, Fast Ambition’s founders earn below Northern Ireland’s median salary after taxes.

- Inflated Valuations: The actual value of the business is far lower than Darren’s claim of £328,000.

- High Risks, Low Returns: With no independent brand identity, Fast Ambition faces significant hurdles in sustaining long-term growth.

For current and prospective FBABB clients, Fast Ambition’s story is a cautionary tale. Before committing to Darren’s program, demand full transparency, verify any claims, and ensure the reality matches the marketing. If something sounds too good to be true, it probably is.