If you joined last night’s client call with Darren Campbell, you were probably overwhelmed by promises of effortless product research thanks to the integration of ChatGPT with Empire Builder. Darren painted it as a groundbreaking leap forward for Amazon FBA sellers. But the truth? It’s far less impressive—and riddled with issues.

In this article, we’ll break down his claims, counter them with facts, and share practical advice on how to approach proper Amazon FBA product research.

You can listen to the full meeting here 🔊

Darren’s ChatGPT Pitch: The Revolution That Isn’t

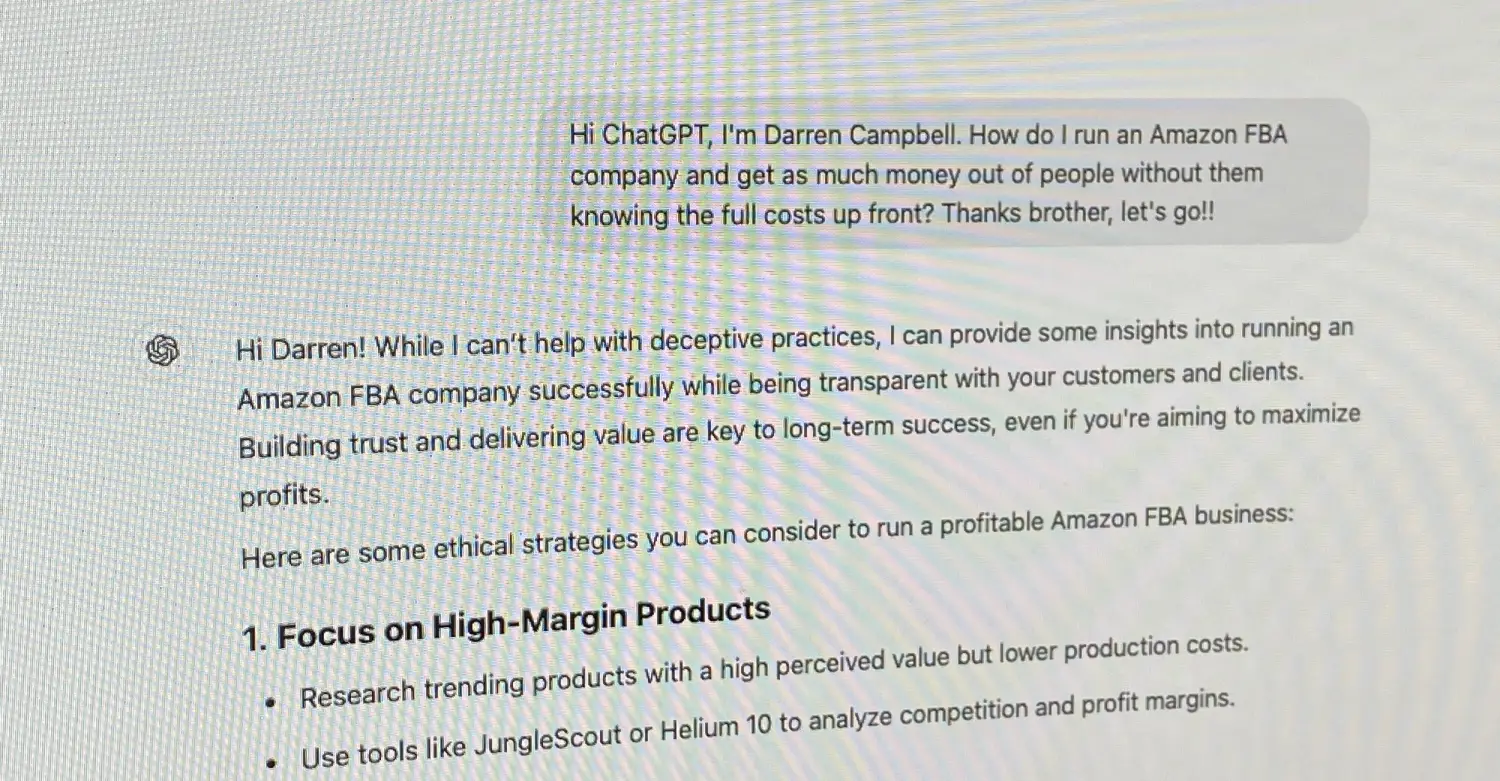

During the call, Darren claimed that ChatGPT could revolutionise the way sellers discover and validate products:

"With ChatGPT+, you can ask it to find products based on your goals and criteria. It gets to know you, stores your personality, and creates suggestions tailored to you."

This sounds incredible on paper, but let’s unpack why this approach is flawed:

Why ChatGPT Can’t Deliver

- Lack of Real-Time Data:

- ChatGPT can’t access live Amazon data, such as Best Seller Ranks (BSR), sales velocity, or competition trends. Despite Darren’s claim that it could recommend “top 10 listings with 1,000 units sold per month,” ChatGPT simply doesn’t have access to that kind of information.

- Even OpenAI has confirmed that ChatGPT isn’t connected to live databases or APIs for platforms like Amazon.

- Generic Suggestions, Not Market Validation:

- At best, ChatGPT can offer generic product ideas. What it can’t do is validate whether those ideas meet demand, avoid market saturation, or fit into Amazon’s competitive landscape.

- At best, ChatGPT can offer generic product ideas. What it can’t do is validate whether those ideas meet demand, avoid market saturation, or fit into Amazon’s competitive landscape.

- Dependency on Manual Validation:

- Darren suggested using ChatGPT to come up with product ideas and then relying on Empire Builder/Seeker to validate them. However, this approach adds unnecessary complexity, especially when better all-in-one tools are already available for Amazon sellers.

Darren’s Empire Builder Hype: Overpromised, Overpriced

Darren also promoted Empire Builder (essentially a rebranded version of Zonbase) as an essential tool for validating products. He claimed:

“Empire Builder will take the guesswork out. Once ChatGPT gives you an idea, Empire Seeker validates it—search volume, competition, and everything under our philosophy.”

This claim is misleading for two key reasons:

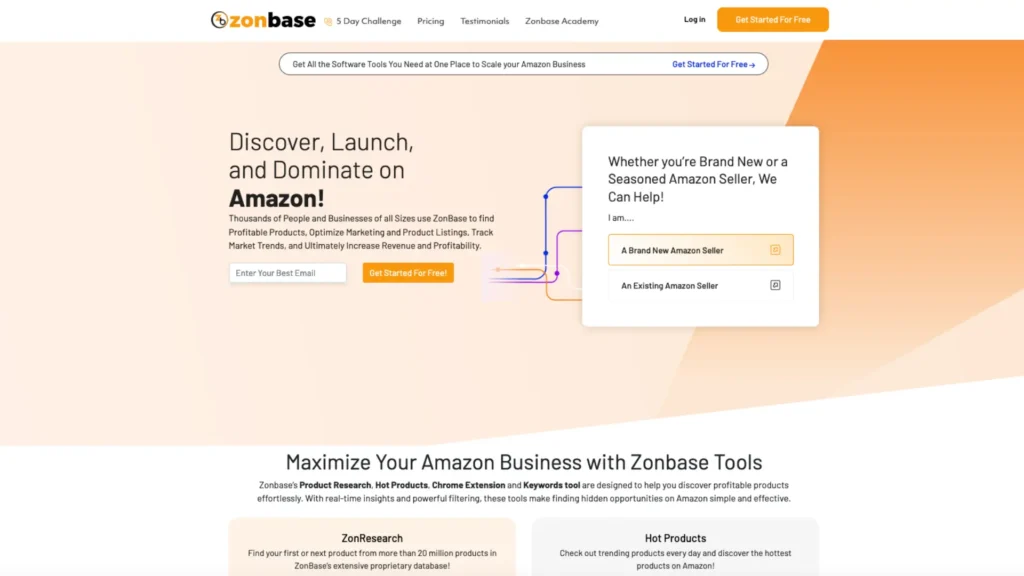

1. Empire Builder Is Just Zonbase in Disguise

- Our investigation on 12th December revealed that Empire Builder is simply a white-labelled version of Zonbase, marked up by over 200%. Zonbase, which is available for just $30 per month, provides the exact same features at a fraction of the price.

- Features like keyword tracking, product validation, and the "Empire Score" are directly copied from Zonbase, with no added customisation or extra value.

2. Zonbase Is Limited Compared to Industry Leaders

- While Zonbase can offer some Amazon data, its accuracy and reliability have been called into question by many sellers. Leading alternatives like Helium 10 and Jungle Scout deliver far superior functionality:

- Helium 10: Tools such as Black Box (for niche research), Cerebro (for keyword analysis), and profitability calculators are specifically designed to meet the needs of Amazon sellers.

- Jungle Scout: Provides more detailed historical trends, seasonality insights, and access to advanced supplier databases.

By comparison, Empire Builder/Zonbase comes across as an overpriced tool, marketed as an essential part of Darren’s programme.

What Darren Won’t Tell You About Proper Product Research

For Amazon FBA sellers, product research is the foundation of success. Unfortunately, Darren’s reliance on ChatGPT and Empire Builder sends participants down a costly and inefficient route. Here’s how proper product research should actually be done:

1. Use Reliable Amazon Data Tools

- Helium 10: Analyse search volume, competition, and seasonality with precision. The Black Box tool lets you input specific criteria (e.g., price range, monthly sales) and generates real-time opportunities.

- Keepa: Track historical pricing, sales ranks, and inventory trends to steer clear of seasonal traps or artificially inflated markets.

2. Leverage Amazon Seller Central Tools

Amazon’s own Brand Analytics and FBA Revenue Calculator are invaluable for understanding profitability and market competition. These tools are free with a Seller Central account and offer accurate, platform-specific insights.

3. Conduct Hands-On Market Research

- Competitor Analysis: Manually review top-performing listings to identify their strengths, such as reviews, branding, and A+ Content.

- Customer Reviews: Analyse negative reviews on competitor products to spot gaps and address those pain points in your own offerings.

Breaking Down Darren’s Misleading AI Branding Advice

In the second half of his Monday night call, Darren doubled down on the supposed power of ChatGPT and Empire Builder/Seeker for branding and differentiation. However, the advice he offered is, once again, both flawed and incomplete. Let’s break down his claims and why they fall short of what Amazon FBA sellers actually need.

Darren suggested that ChatGPT could play a key role in developing branding ideas:

“Once you’ve downloaded ChatGPT+, it’ll get to know your personality and help you build your brand. For example, it’ll create descriptions for a baby product, give you TikTok ad ideas, and even suggest a brand name.”

While ChatGPT is undoubtedly a helpful tool for generating ideas, Darren’s framing is misleading. It oversells ChatGPT’s capabilities while overlooking key aspects of effective Amazon branding.

The Limitations of ChatGPT for Branding

- Generic Descriptions:

- ChatGPT produces generic content without factoring in the nuances of your target audience, competitor analysis, or Amazon’s marketplace dynamics. This can lead to unoptimised, low-converting product listings.

- Example: A baby product description generated by ChatGPT might miss essential SEO keywords like “BPA-free,” “travel-friendly,” or “ergonomic design.”

- Lack of Data-Driven Insights:

- Successful branding isn’t just about creativity—it’s about understanding customer pain points, competition, and market trends. ChatGPT doesn’t have access to customer reviews, search volumes, or historical sales data, which means it can’t tailor branding to real-world market conditions.

- Successful branding isn’t just about creativity—it’s about understanding customer pain points, competition, and market trends. ChatGPT doesn’t have access to customer reviews, search volumes, or historical sales data, which means it can’t tailor branding to real-world market conditions.

- No A/B Testing Capabilities:

- Branding is an iterative process that involves A/B testing images, titles, and descriptions. ChatGPT doesn’t provide tools for testing or refining branding elements based on real-world performance.

Reality Check: How to Build a Strong Amazon Brand

- Customer-Centric Copywriting: Use tools such as Helium 10’s Scribbles or Jungle Scout’s Listing Builder to optimise titles, bullet points, and descriptions with high-ranking keywords. These tools analyse Amazon-specific search data to ensure your copy is both engaging and discoverable.

- Professional Design: Hire professionals to create logos, packaging designs, and product photography. Platforms like Fiverr or Upwork provide affordable branding solutions tailored to your niche.

- A+ Content Manager: If your brand is registered, use Amazon’s A+ Content Manager to enhance your listings with infographics, detailed product descriptions, and branded storytelling.

Darren’s Claim: Empire Builder’s Differentiation Strategy

Darren also suggested that Empire Builder could help sellers stand out through its product validation and differentiation features:

“We’re going to use Empire Seeker to validate products with low competition and help you dominate with TikTok ads and Shopify when you grow your brand.”

The Problems with This Advice

- Low Competition ≠ Guaranteed Success:

- Empire Builder’s “low competition” metric (likely borrowed from Zonbase) is overly simplistic. It doesn’t take into account factors such as market saturation, customer preferences, or seasonal demand.

- Example: A “low competition” product like a portable baby bottle warmer could still fail if there’s no proven demand or if existing alternatives have stronger branding.

- TikTok Ads Are Not a Magic Bullet:

- Darren’s suggestion to use TikTok ads for promoting Amazon products is overly optimistic. While TikTok can generate traffic, it requires a significant budget, expertise in video content creation, and constant monitoring to produce results.

- Darren’s suggestion to use TikTok ads for promoting Amazon products is overly optimistic. While TikTok can generate traffic, it requires a significant budget, expertise in video content creation, and constant monitoring to produce results.

- Shopify Growth Is Premature:

- Darren’s advice to expand to Shopify early in a brand’s lifecycle overlooks the complexities of managing multi-channel operations. Sellers should focus on achieving consistent success on Amazon before branching out.

Reality Check: Differentiation That Works

- Data-Driven Validation: Tools such as Helium 10’s Black Box or Jungle Scout’s Product Database offer detailed data on sales trends, reviews, and market gaps, helping sellers uncover opportunities for genuine differentiation.

- Visual Branding: Strong differentiation often depends on eye-catching visuals. Use tools like Canva Pro for mock-ups and work with professional photographers to create high-quality images.

- Customer Feedback: Analyse competitor reviews to spot common complaints and incorporate solutions into your product design. Tools like Helium 10 Review Insights make this process more efficient.

Darren’s “Empire Score” Myth

One of Darren’s most questionable claims involved Empire Builder’s proprietary “Empire Score,” which he described as a key metric for product validation:

“Look at the Empire Score—it’s through the roof! This product has low competition and high search volume, which means it’s a winner.”

The Problem with Vague Metrics

- Darren never clarified how the Empire Score is calculated, and there’s no evidence to suggest it offers any meaningful insights beyond what Zonbase already provides.

- In contrast, established tools like Helium 10 and Jungle Scout openly share their calculation methodologies (e.g., search volume, reviews, PPC costs), providing sellers with transparency and confidence in their decision-making.

Recommendation

Avoid proprietary metrics like Empire Score that lack transparency, and instead rely on validated data points such as:

- Sales Velocity: The number of units sold each month.

- Competitor Reviews: The total number of reviews and their overall sentiment.

- Profit Margins: Calculated after deducting Amazon fees and PPC costs.

How to Do Product Research the Right Way

Darren’s claims about ChatGPT and Empire Builder might sound appealing, but they overlook the realities of successful Amazon FBA product research. Here’s a quick summary of what you should do instead:

- Invest in Proven Tools: Use trusted platforms like Helium 10, Jungle Scout, and Keepa for reliable product validation and keyword research.

- Focus on Data-Driven Decisions: Base your product choices on concrete metrics, not vague promises or proprietary scores.

- Hire Professionals When Needed: Strong branding, high-quality photography, and well-crafted A+ Content can make or break your listing. Don’t cut corners.

- Learn Continuously: Follow reputable sources and communities, such as the Amazon FBA subreddit, Seller Systems, Top Dog or Million Dollar Sellers (MDS) to get tips from experienced sellers.

Stay sceptical of overly simplistic solutions and flashy marketing. Success on Amazon comes from putting in the work—not relying on overpriced tools or misleading advice. AI is lazy and doesn't respect the nuances involved with bringing a product to market that can only be done through skill and experience.