When it comes to taxes and VAT compliance, Darren Campbell’s FBA Brand Builder program seems to be causing more harm than good. From dodgy advice about the W-8BEN-E tax form to misleading claims around zero-rate VAT for sellers in Northern Ireland, the guidance being handed out is packed with inaccuracies. Worse, the accounting service Campbell endorses—FFC Bookkeeping, run by Richard Ferson—appears to be reinforcing this misinformation.

The result? Clients are left vulnerable to audits, penalties, and serious financial stress.

Let’s break down how this advice isn’t just wrong but potentially harmful for anyone trying to navigate the complex world of Amazon FBA.

The Zero-Rate VAT Myth

One of the standout claims made by Richard Ferson in the program’s training materials is that Amazon sellers in Northern Ireland can qualify for zero-rate VAT if they’re selling to US customers. It sounds great, but the reality is a lot more complicated—and restrictive.

"If you’re based in Northern Ireland and your sales are going to the US, you can qualify for zero-rate VAT because the goods are being exported out of the UK."- Richard Ferson

What is Zero-Rate VAT?Zero-rate VAT means you don’t charge VAT (Value Added Tax) on your goods or services, but you can still reclaim any VAT you paid on business expenses related to those sales.

For example, if you sell products to customers outside the UK and meet specific export rules, you might qualify for zero-rate VAT. This reduces costs for the buyer and lets you recover VAT you paid when sourcing or producing the goods.

What rules Apply?Strict rules apply:

- The goods must leave the UK and be delivered directly to the customer in another country.

- You need to keep proof of the export, like shipping documents.

If these conditions aren’t met, you can’t zero-rate the sale.

Problems for FBABB clientsIf you’re following Richard’s advice on zero-rate VAT in the FBA Brand Builder program, you could face big problems. Zero-rate VAT only applies if goods are exported directly from the UK to customers abroad, but most FBA sellers source from China and ship straight to Amazon in the US. This doesn’t qualify.

Claiming zero-rate VAT incorrectly could lead to HMRC demanding unpaid VAT, plus penalties and interest. Worse, shipping directly from China creates a tax gray area, potentially leaving you liable for taxes in the US or elsewhere. Poor advice could land you in a costly and stressful mess.

1. Goods, Not Services: What Zero-Rate VAT Actually Covers

Zero-rate VAT primarily applies to physical goods exported from the UK and shipped directly to customers outside of the country. At first glance, this might seem relevant since Darren’s program focuses on selling $100+ physical products, often sourced from platforms like Alibaba. But when you factor in how Amazon FBA logistics work, things quickly unravel.

2. Destination Rules: Where Are the Goods Actually Going?

To meet the requirements for zero-rate VAT, the goods must be directly exported from the UK to the end customer or the destination country. This is where Darren’s guidance starts to fall apart:

- The Common FBA Model: Most clients source products from Chinese suppliers through Alibaba, which are then shipped straight to Amazon’s warehouses in the United States (or other countries). These goods never pass through the UK, so they don’t qualify as being “exported” from the UK. Without this step, the sale doesn’t meet the zero-rate VAT criteria.

- Amazon’s Fulfillment Network: Even if products are shipped to Amazon warehouses, there’s another problem. The goods aren’t being sent directly to the end customer. Instead, they’re stored in fulfillment centers before being sold and distributed domestically within the US (or other regions). This fails to satisfy the “direct export” requirement needed for zero-rating.

By misunderstanding these logistics, Darren’s program leaves clients exposed to significant compliance risks.

Tax Compliance Risks

For clients who trust the advice without diving deeper into VAT regulations, the consequences could be severe:

- Incorrect Zero-Rate VAT Claims

Claiming zero-rate VAT when the criteria aren’t met could trigger a red flag with HMRC. Businesses may be forced to repay the VAT owed, plus penalties and interest. - Cross-Border Tax Compliance Issues

Since these goods are shipped directly from China and sold through Amazon in the US, the VAT compliance responsibility often shifts—sometimes to the supplier, the US tax system, or even Amazon itself. This creates a legal gray area, leaving sellers at risk of audits and unforeseen liabilities. - Long-Term Damage

Many Amazon FBA sellers already operate on thin margins due to high advertising costs and overhead. Add an unexpected VAT bill or compliance issue, and it could be enough to sink the entire business.

Danger: If clients mistakenly assume they don’t need to file VAT returns or meet other compliance requirements because they believe their sales qualify as zero-rated, they risk audits, fines, or penalties from HMRC.

A Pattern of Misleading Advice

Unfortunately, the misinformation around zero-rate VAT isn’t an isolated issue. Darren’s team has also offered questionable advice about the W-8BEN-E tax form.

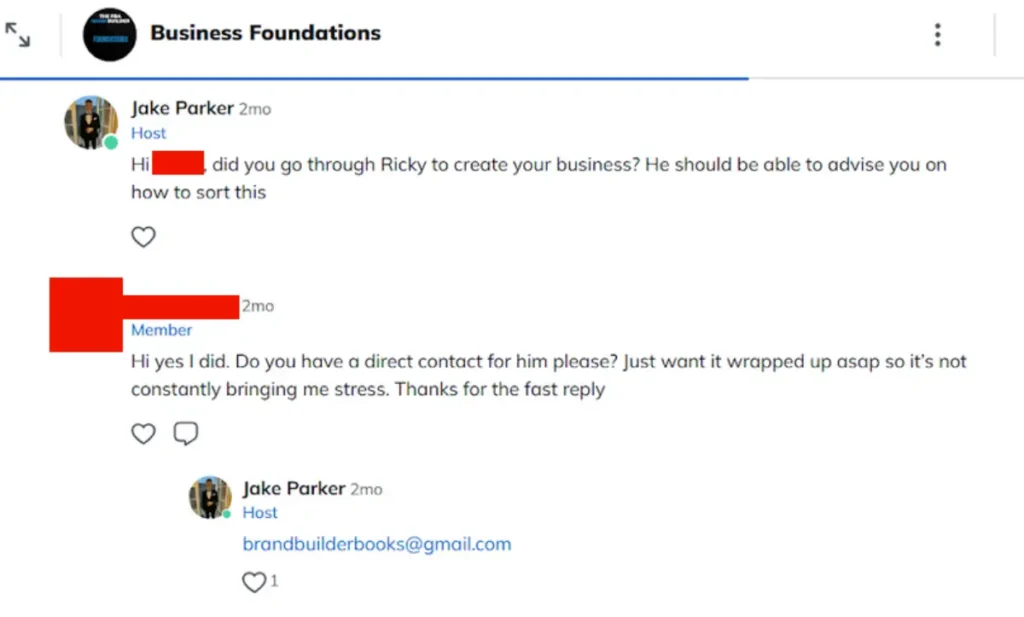

Advisors like Kayley Hutchison and Jake Parker have told clients to classify their businesses as “Private Foundations” on the form. This advice is wildly inaccurate and could lead to:

- IRS Red Flags: Misclassifying your business can attract unwanted attention from the IRS, potentially triggering audits or complications with withholding taxes.

- Account Delays: Incorrect tax form submissions can hold up account approvals, delaying cash flow and product launches.

Whether it’s zero-rate VAT or W-8BEN-E forms, the advice being handed out demonstrates a serious lack of understanding—or, worse, an indifference to the real-world impact on clients.

Where’s the Accountability?

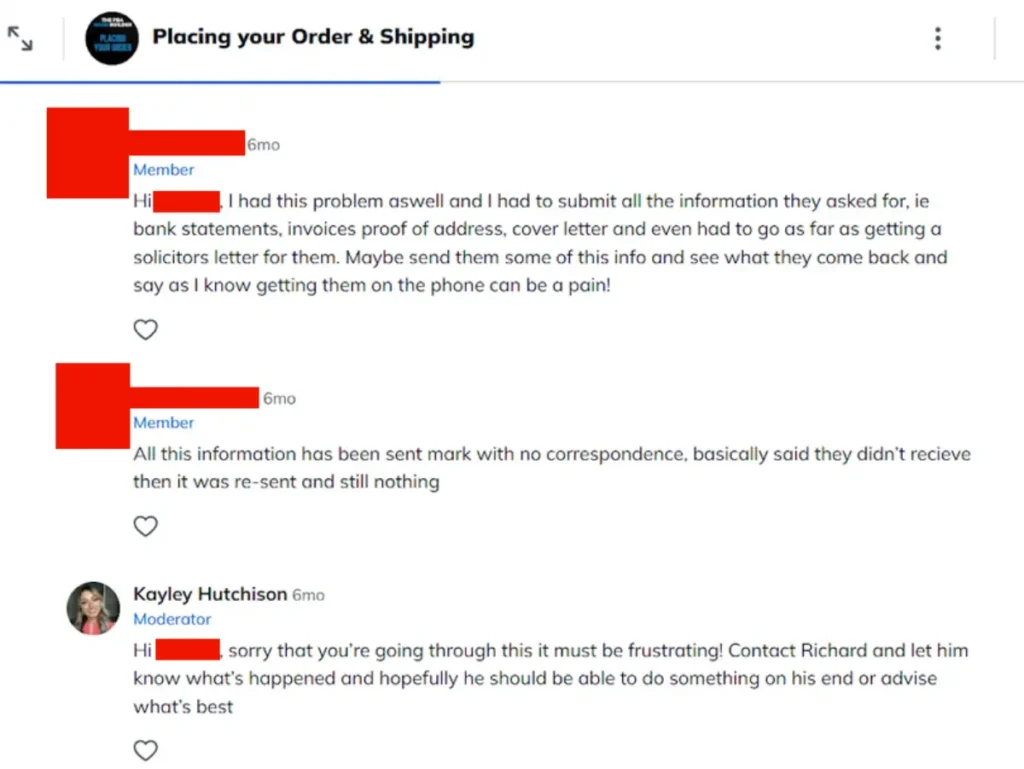

As Darren’s recommended accountant, Richard Ferson should be providing clarity, not confusion. Yet, clients who pay £75/month for FFC Bookkeeping’s services are still running into costly errors. From VAT deregistration mishaps to late filing penalties, posts from frustrated clients in the Mighty App community suggest Richard’s involvement is doing little to solve—or prevent—these issues.

And here’s the kicker: Darren Campbell was previously a director of FFC Bookkeeping, raising questions about whether this arrangement is designed to benefit clients—or just to pad Campbell’s wallet.

Voices of Frustration

Here’s what some FBA Brand Builder clients have shared about their struggles with VAT compliance and accounting:

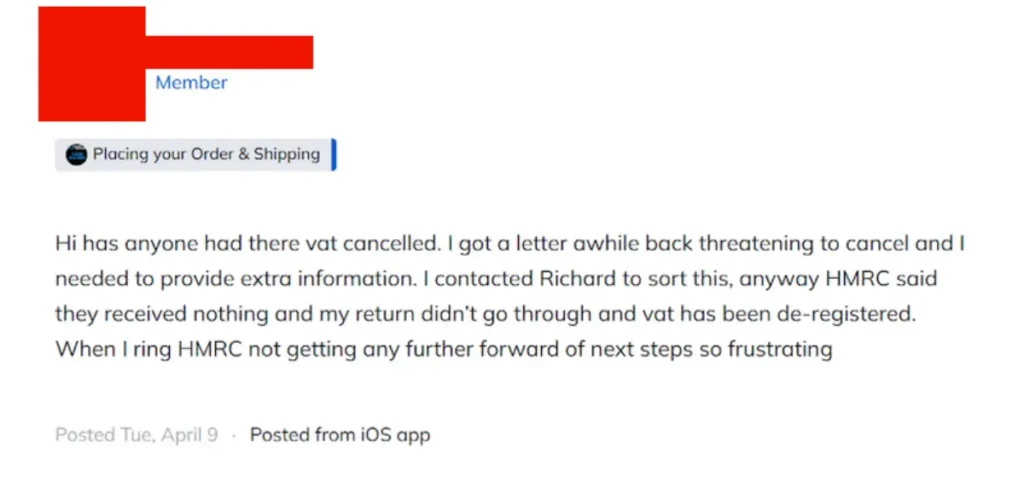

- “I got a letter threatening to cancel my VAT, and Richard said he would sort it. HMRC said they received nothing, and now I’ve been de-registered.”

- “Our VAT number was cancelled by HMRC, and they’ve asked for so much information to restore it—signed contracts, invoices, proof of trade… This is so stressful.”

- “I’ve tried multiple times to file my VAT return but keep getting letters saying I’m in debt even though I haven’t started trading yet.”

The pattern is clear: bad advice, minimal support, and clients left to deal with the fallout on their own.

Why This Matters

For a program marketed as comprehensive mentorship, the gaps in Darren Campbell’s tax and VAT guidance are glaring. Clients are paying thousands upfront, plus ongoing expenses, only to end up risking non-compliance and financial hardship.

Key takeaways:

- Lack of Transparency: Clients aren’t being fully informed about the complexities of VAT compliance or the risks involved.

- Missed Responsibility: FFC Bookkeeping, as the recommended service, should be fixing these issues—not adding to them.

- Long-Term Consequences: VAT and tax mistakes can lead to audits, penalties, or even business closure, leaving clients worse off than when they started.

The Bottom Line: How To Avoid Risk

Darren Campbell’s FBA Brand Builder program promises to give clients everything they need to succeed in Amazon FBA, but when it comes to critical areas like taxes and VAT compliance, it’s falling dangerously short.

One of the selling points of FFC Bookkeeping, the accounting service recommended by Darren, is the promise: “That’s why we handle everything for you—bookkeeping, VAT returns, annual accounts—so you can focus on growing your Amazon business without worrying about compliance.” While this might sound reassuring, it fosters a reliance on a service already tied to widespread confusion and mismanagement, as seen in countless community comments and participant struggles.

Whether through ignorance, incompetence, or intentional shortcuts, the program’s tax advice leaves clients at unnecessary financial and legal risk.

For anyone considering this program, the evidence is clear: proceed with extreme caution. Verify every piece of advice independently, because in a business where profit margins are tight and mistakes can snowball, the cost of getting it wrong is far too high.