The FBA Brand Builder markets itself as a program designed to create successful Amazon sellers through expert mentorship and insider knowledge. However, as more client experiences and internal guidance come to light, a troubling pattern of behavior is becoming increasingly apparent.

From inflated income figures on financial applications to advice that blurs ethical boundaries, Darren Campbell’s program seems focused less on genuine support and more on keeping clients moving through an expensive pipeline of add-ons.

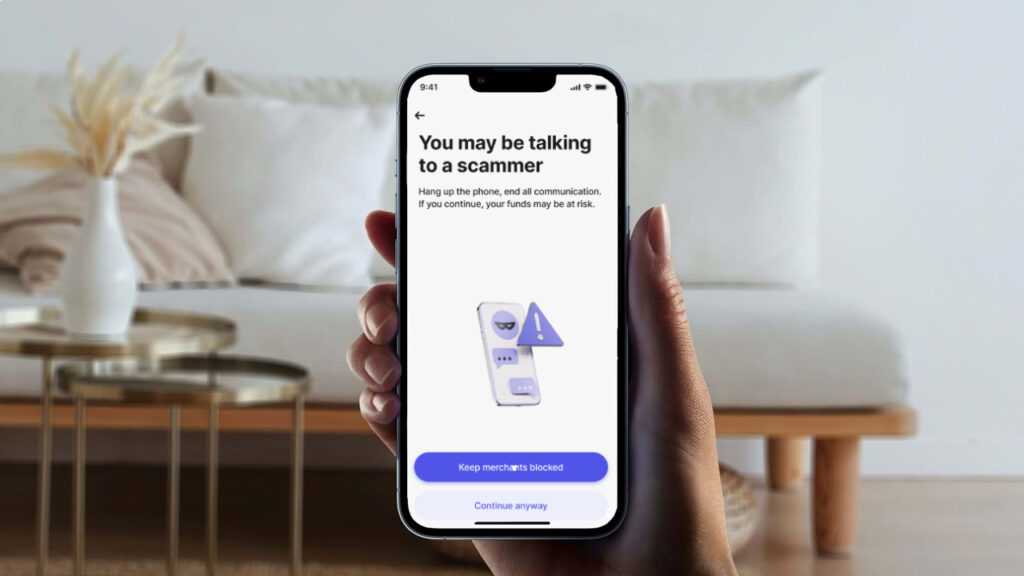

Misleading Revolut Applications

A recently surfaced video from the FBA Brand Builder walks clients through the Revolut business account application process. While Revolut is a legitimate tool for small businesses, the advice shared in the video raises eyebrows.

Clients are instructed to input exaggerated figures, such as claiming an annual turnover of £100,000 to £1,000,000 and monthly transfers between £10,000 and £100,000—numbers that are not reflective of their actual business operations, especially for those just starting their Amazon journey.

Here’s a quote from the video:

Don't believe us? See for yourself by checking out the full training video below.

Revolut’s terms and conditions explicitly warn against dishonesty on applications:

"All information provided must be truthful and accurate. Providing false information could result in account closure and further action."

The risks here are clear—clients could face financial repercussions or even have their accounts terminated. Yet Darren's team seems unconcerned with the potential fallout, instead prioritizing the approval of applications to keep clients on track within the program.

Editing Supplier Quotes: Ethical Shortcuts

Adding to the questionable practices is advice shared by team member Kayley Hutchison, who recently recommended using Canva to “edit” supplier quotes to negotiate lower prices from competitors. While negotiation is a standard part of business, altering official documents to mislead suppliers crosses a line. Kayley’s exact words from her weekly call were:

This isn’t just unethical—it could damage relationships with suppliers and raise legal issues for clients who follow this advice.

A Costly Program That Keeps You Paying

Why does it seem so critical for Darren and his team to ensure clients get financial applications approved, whether through Revolut, American Express, or other means? The answer lies in the expensive ecosystem Darren has built around the FBA Brand Builder.

After the £6,500 initial fee, clients are funneled into a range of ongoing costs:

- £150/month for the Growth Programme: This subscription is mandatory and claims to offer continued support.

- £175/month for PPC management: Campaigns are handled by Darren’s own FBA Studio team, whose expertise has come under scrutiny.

- £99/month for Empire Builder software: This proprietary tool promises to help clients manage their brand more efficiently. Darren and the Zab Twins get commission when you buy this.

- £75/month for accounting services: Many clients are directed to Richard, an accountant with whom Darren appears to have a business relationship.

When combined with Amazon’s own fees for PPC advertising, fulfillment, and storage, these additional costs can add up quickly—often leaving clients financially strained long before their brands gain traction.

A Clear Pattern of Fraud

The guidance on Revolut applications mirrors the advice Darren was caught giving about American Express applications, where clients were encouraged to inflate income and turnover figures. These practices aren’t isolated incidents—they form part of a broader strategy that prioritizes the program’s profitability over clients’ financial well-being.

The Belfast Telegraph’s exposé included video footage of Darren instructing clients to claim they earned £36,000–£38,000 per year, even if this wasn’t true, to avoid being flagged for rejection. He also advised clients to list projected business turnovers of £150,000–£200,000, regardless of whether their businesses had launched.

A Pipeline That Benefits Darren

Ultimately, it’s Darren—not the clients—who benefits most from ensuring these applications are approved. The faster clients move through the onboarding process, the sooner they’re funneled into the expensive monthly subscriptions that sustain his business model.

For clients struggling to keep up with these mounting costs, the responsibility for failure is often shifted back onto them, with phrases like “you need the right mindset” or “you have to go all in” used to deflect criticism of the program’s support.

However, when questionable practices like misrepresentation on financial forms and editing supplier quotes are actively encouraged, it’s worth asking whether the program itself is setting clients up for failure.

Closing the Loop on Financial Misconduct

Darren’s FBA Brand Builder promotes itself as a program led by experts who guide clients toward entrepreneurial success. But when the advice includes falsifying financial figures and altering official documents, the program’s credibility takes a serious hit. Revolut, like American Express, has clear policies against dishonesty, yet Darren’s team seems willing to gamble with clients’ futures to keep them paying into the system.

And while Kayley’s shared American Express referral link shows that Darren and his team never miss an opportunity to earn additional commission, the real cost is borne by the clients—many of whom find themselves deeper in debt with little to show for it.

As more of these practices come to light, the question remains: Is this really a mentorship program, or a finely tuned profit machine that prioritizes its own bottom line over the success of its clients?

We have reached out to Revolut for comment regarding this alleged fraudulent activity and the guidance provided by The FBA Brand Builder. This article will be updated if and when a response is received.