When you shell out £6,500 for a mentorship program like Darren Campbell’s FBA Brand Builder, you expect solid, reliable advice to steer you toward success. But what happens when even the basics—like tax compliance—are completely bungled?

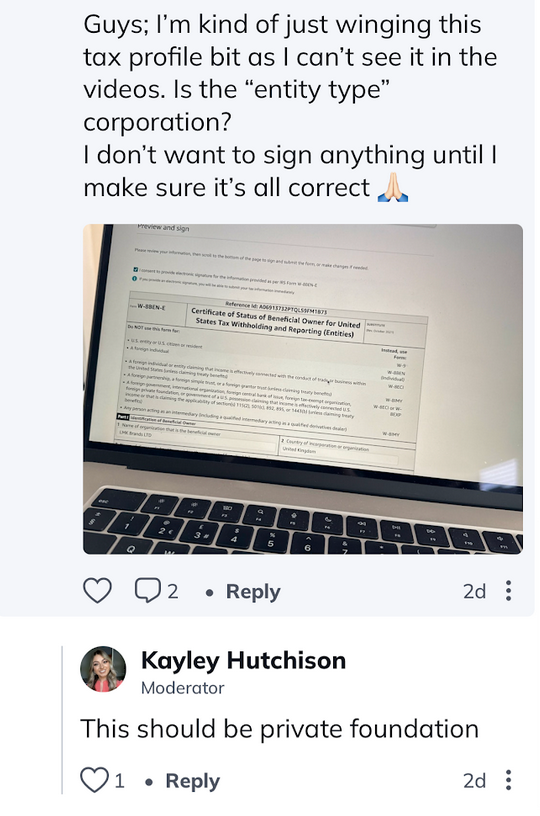

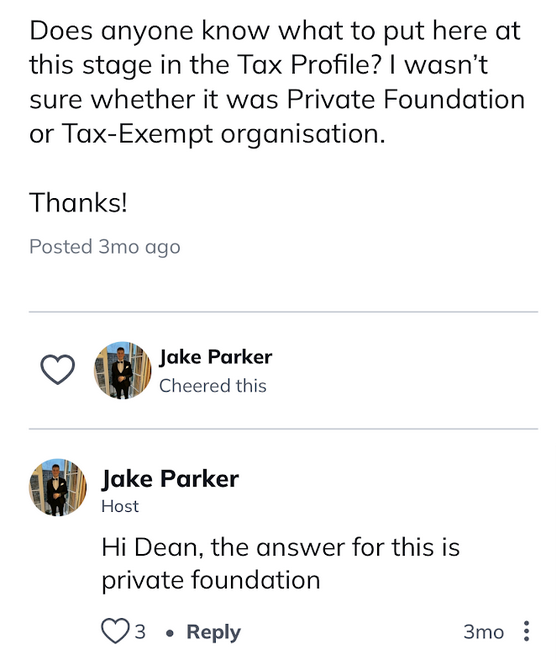

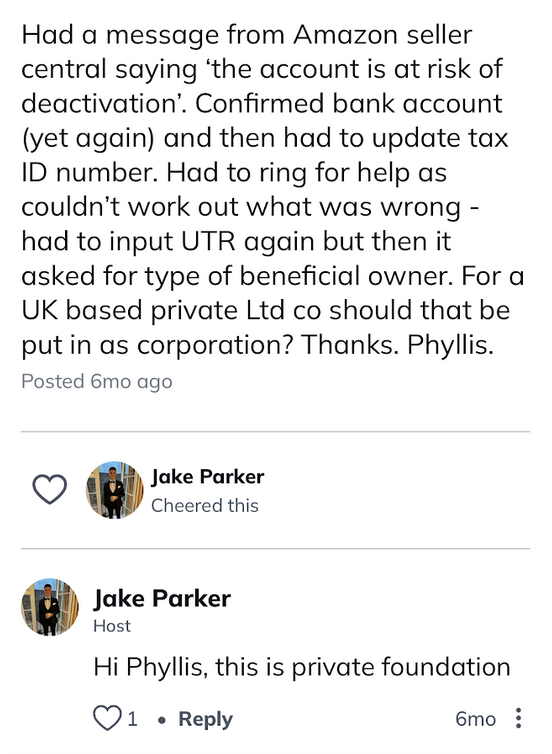

Recent discussions in the program’s Mighty App community have highlighted deeply concerning advice from Darren’s team members, Kayley Hutchison and Jake Parker, on completing Amazon’s W-8BEN-E tax form. Their recommendation to select “Private Foundation” as the entity type isn’t just wrong—it’s outright alarming.

Is this simply a case of poor training, or does it suggest something more sinister, like ignorance about the consequences or even a shady attempt at tax avoidance?

What Is the W-8BEN-E Form?

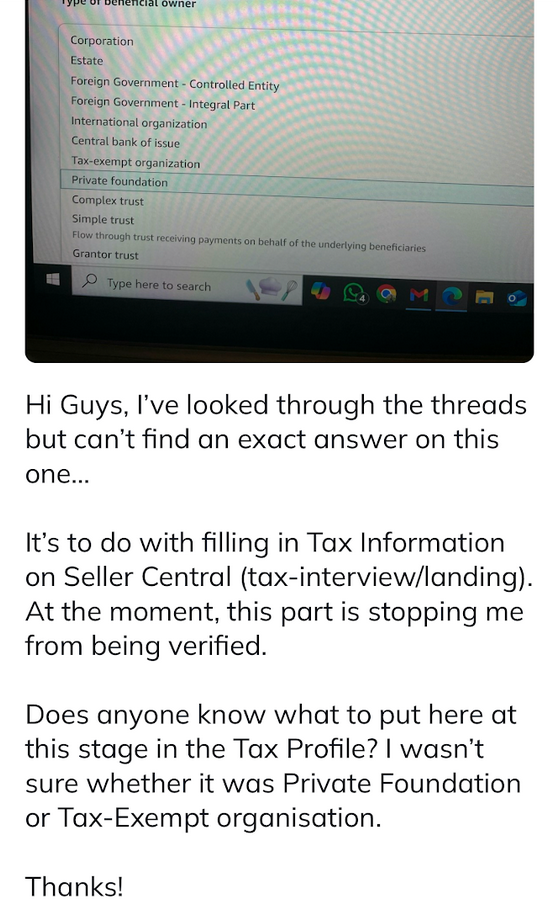

For non-US sellers like UK-based Ltd companies, the W-8BEN-E form is a critical document. It ensures businesses benefit from reduced withholding tax rates under treaties (like the US-UK tax treaty) and are correctly classified for US tax purposes. For UK companies, the proper classification is “Corporation.”

Getting this form wrong can lead to major headaches:

- Account Delays: Amazon might hold up your account approval.

- Tax Mistakes: Incorrect classifications could lead to higher withholding taxes or potential IRS scrutiny.

- Legal Risks: Missteps can invite penalties or audits down the line.

The Dangerous Advice: “Private Foundation”

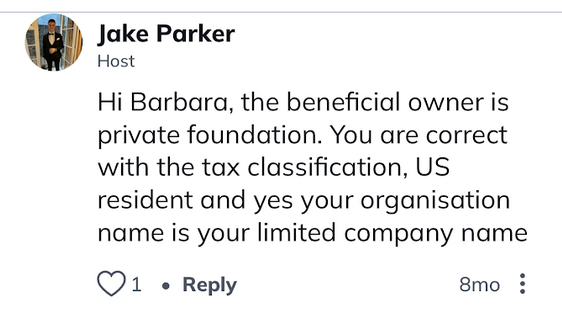

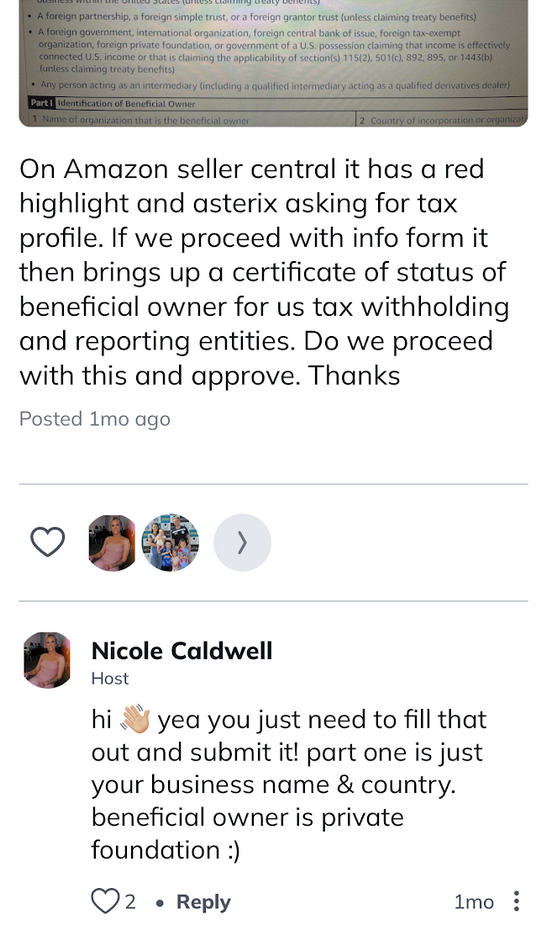

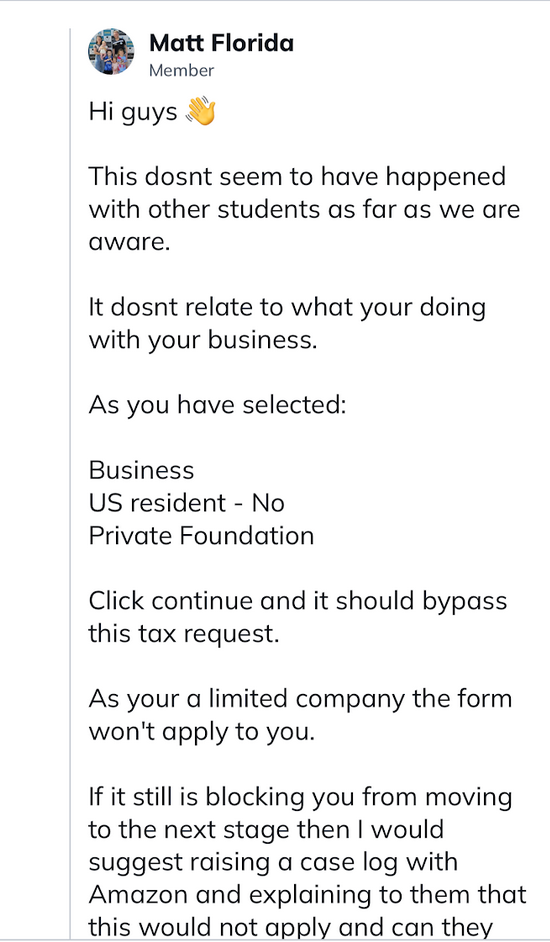

Kayley Hutchison and Jake Parker, both members of Darren’s team, repeatedly advised participants to select “Private Foundation” as their entity type. Here’s what they’ve said:

- Kayley: “This should be private foundation.”

- Jake: “The answer for this is private foundation.”

Here’s the issue: a “Private Foundation” is specifically a charitable entity—not a for-profit business like a UK Ltd company. This advice is not just wrong—it could create serious consequences for sellers.

Why This Advice Is a Problem

1. It’s a Misclassification Nightmare

Choosing “Private Foundation” on the W-8BEN-E could lead to:

- Delays and Confusion: Amazon might flag your account for additional checks.

- Incorrect Withholding Taxes: You could end up with the wrong rates, which would directly impact profitability.

- IRS Red Flags: Misclassifications are a compliance risk, especially if the IRS decides to investigate.

2. Ignorance or Something Worse?

At best, this advice shows an alarming lack of understanding. At worst, it could hint at attempts to skirt tax rules by exploiting loopholes—although there’s no hard evidence of intent to deceive. Either way, the damage lands squarely on the participants.

The Bigger Picture: A Pattern of Poor Guidance

This isn’t just about a tax form. It’s yet another example of Darren Campbell’s program providing bad advice that puts participants at risk. Here’s what this incident tells us about the broader failings:

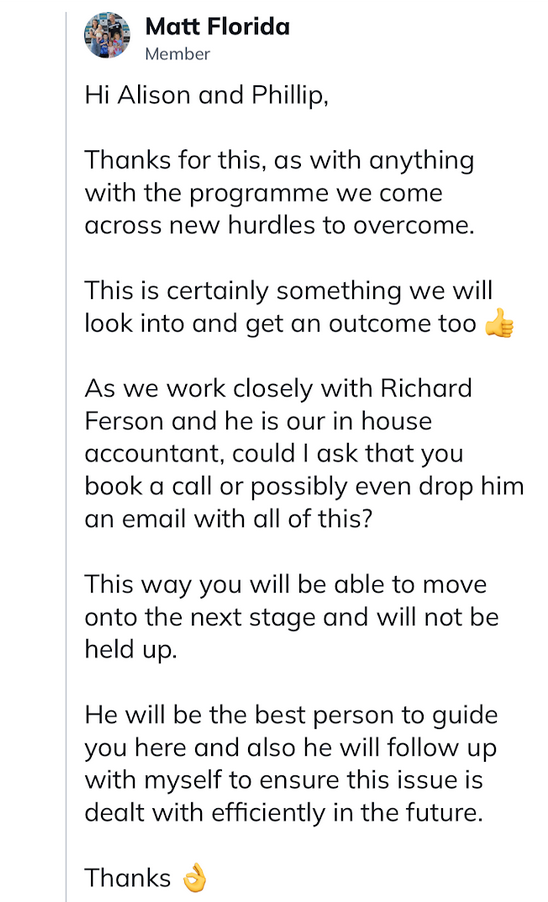

- Unqualified Advisors: Kayley and Jake don’t appear to have any qualifications in tax or accounting, yet they’re confidently offering advice on highly technical issues.

- Inconsistent Guidance: Missteps like this aren’t rare. From PPC mismanagement to vague responses to financial struggles, the program has a pattern of leaving participants confused and unsupported.

- Reliance on the Team: Darren’s program doesn’t teach participants how to verify or understand critical processes themselves. Instead, they’re told to rely on his team—who repeatedly get it wrong.

Why This Matters

1. Shattered Trust

Participants invest significant money and trust in the program, expecting expert advice. When they’re misled on something as important as tax compliance, it undermines the entire program’s credibility.

2. Real Risks, Real Costs

Tax mistakes can have serious consequences, from withheld earnings to legal penalties. For sellers already struggling to break even, these errors could push them further into financial trouble.

3. A Bigger Question of Expertise

If the team can’t handle something as fundamental as tax guidance, how qualified are they to advise on the other complexities of running an Amazon business?

The Takeaway: Don’t Settle for Misleading Advice

This incident is yet another reminder of the glaring issues within Darren Campbell’s FBA Brand Builder program. Participants are paying thousands for mentorship and expertise but instead receive incomplete training, vague advice, and guidance that could lead to costly mistakes.

The program’s heavy focus on motivational rhetoric distracts from its inability to provide practical, actionable tools. Participants deserve better than unqualified advice, poorly trained team members, and a “trust the process” mantra that fails to deliver results.

Please, For The Love of God, Protect Yourself

Before committing to any high-cost mentorship program, ask yourself:

- Are the advisors qualified to give guidance on critical areas like taxes or PPC?

- Does the program teach you how to run your business independently, or does it create reliance on its team?

- Are all the costs and risks being disclosed upfront, or are you being sold a dream without the details?

And if you’re already in the program, don’t take their advice at face value. Double-check everything—especially on essential matters like taxes. It could save you from costly mistakes and unnecessary stress.