Making the tough call to stop investing in something that feels like a dead end is never easy. When you’ve already poured in so much time, money, and effort, the thought of walking away can feel unbearable—even when you know, deep down, it might be the right move. This is the sunk cost fallacy at work, and it’s something we see countless FBABB clients struggle with.

Letting go of a dream you’ve invested so much in is overwhelming. For many, joining the FBABB program meant chasing financial freedom, working from home, and creating a better life for their families. But when the reality starts to hit—unexpected fees, poor guidance, or rapidly depleting finances—you can feel trapped, as if there’s no turning back.

Recently, one of our community members posted about this very dilemma in our Q&A Hub. Among the advice shared, one suggestion stood out: they were encouraged to read up on the sunk cost fallacy—a fantastic recommendation. Understanding this concept can shift your perspective and make tough decisions a little clearer. Their question—and the thoughtful responses that followed—offer valuable insight for anyone wrestling with whether to stay the course or walk away. Let’s dive into what they had to say.

Understanding the Sunk Cost Fallacy

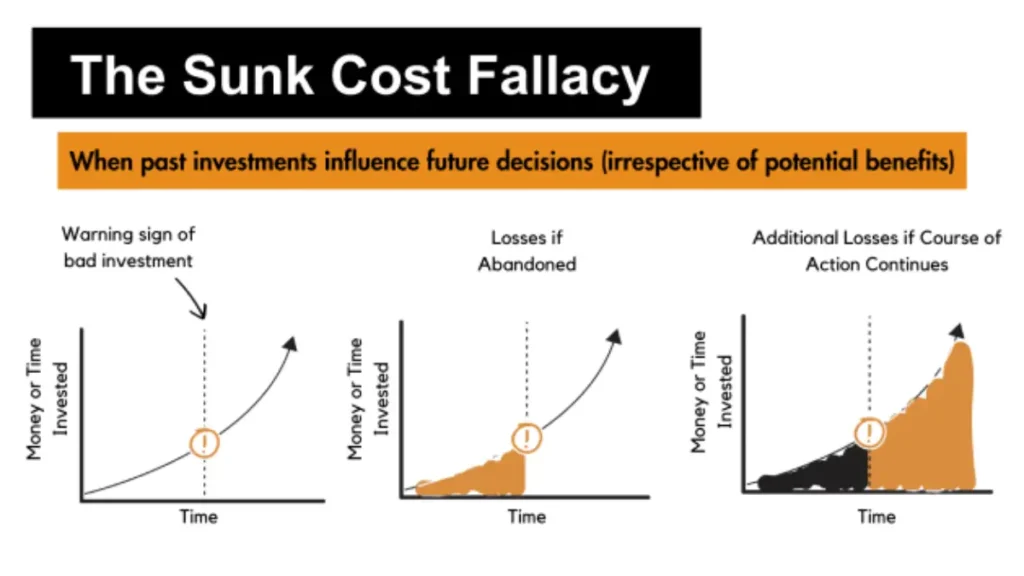

The sunk cost fallacy is our natural tendency to hold on to an investment simply because we’ve already put so much into it—even when walking away would make more sense. In economics, sunk costs are considered irrecoverable. Whether it’s the £6,500 FBABB sign-up fee or the extra expenses for samples, trademarks, and PPC, that money is spent and can’t be recovered. But the emotional pull of those investments often keeps clients pushing forward, even when the chances of success start to feel painfully slim.

This fallacy taps into a mix of emotional and psychological factors that make it hard to walk away:

- Loss Aversion: The fear of losing what we’ve already put in feels far greater than the potential relief or benefits of cutting our losses.

- Commitment Bias: There’s a natural desire to stay consistent with past decisions, even when new evidence suggests they weren’t the right ones.

- Hope for Redemption: Many cling to the belief that success is just within reach—if only they invest a little more time or money.

But at what cost? For FBABB clients, this often means digging themselves even deeper into financial stress, chasing a return that may never come.

The Question That Started the Conversation

Recently, one of our community members shared this heartfelt post in our Q&A Hub:

I have chatted with a lot of the success stories privately who, after several months, are really struggling financially and don't have the money to invest into a second product as they're so deeply in debt following the first one.

It has been said many times that this is a 2-3 year journey, but I'm not going to have the capital to even make one product successful, going by the information I'm looking at. Do you have any advice?"

The post struck a chord with a few people in the community, sparking meaningful conversations about how the sunk cost fallacy could be keeping them stuck. One member suggested reading up on this psychological trap—that inspired us to explore the topic further in this article.

Signs You Might Be Caught in the Sunk Cost Fallacy

Not sure if this applies to you? Here are some common signs to watch for:

- You’re Reluctant to Quit Because of Past Investments: You’ve already spent £6,500 on the program—maybe even more on extras—so you feel like you have to keep going to "make it worth it."

- You’re Ignoring Warning Signs: Conflicting advice from mentors, skyrocketing costs, or minimal returns aren’t enough to shake your commitment.

- You’re Afraid of Admitting a Mistake: Acknowledging you were misled or made a poor decision can feel embarrassing, even though it’s not your fault.

- You Keep Hoping for a Breakthrough: You’re convinced that success is just around the corner if you invest in one more thing—whether it’s a second product, extra PPC spending, or more time in the program.

If any of these sound familiar, it might be time to step back and reevaluate where you’re headed.

Real Stories from FBABB Clients

Many FBABB clients have found themselves grappling with similar struggles. One member shared their experience:

"I was determined to make it work because I’d already spent so much. But after sinking another £10,000 into PPC, branding, and samples with barely any return, I realized I was just throwing good money after bad. The hardest part was admitting to myself that continuing wasn’t the solution."

Another reflected on their journey:

"I kept telling myself it would turn around if I stuck it out. But the truth was, the odds of success were never what I thought they’d be. I wish I had listened to my gut sooner instead of doubling down."

These stories highlight just how difficult it can be to break free from the sunk cost fallacy, but they also serve as a reminder: recognizing the trap is the first step to moving forward.

How to Break Free from the Sunk Cost Fallacy

Recognizing the sunk cost fallacy is the first and most crucial step to breaking free. Here are some actionable ways to help you move forward:

- Focus on Future Costs and Benefits

Take a step back and ask yourself: What will it cost me—financially and emotionally—to continue? What am I realistically likely to gain? Be brutally honest with yourself about whether staying the course is worth the toll it’s taking. - Reframe the Narrative

Walking away isn’t failure; it’s a smart decision to cut your losses and redirect your energy toward something more rewarding. Letting go is often the best way to move forward. - Seek Support and Alternatives

Reach out to others in our community who’ve faced similar challenges. Many have found ways to use what they learned from FBABB on their own terms, without the ongoing costs of the program. - Know Your Rights

If it’s been less than 120 days since you made a payment, you may still be able to file a chargeback with your bank or credit card provider. If that window has passed, don’t lose hope—check out our refund guide for additional options.

Breaking free from the sunk cost fallacy isn’t easy, but it’s a powerful step toward regaining control and moving forward with clarity.

Moving Forward with Confidence

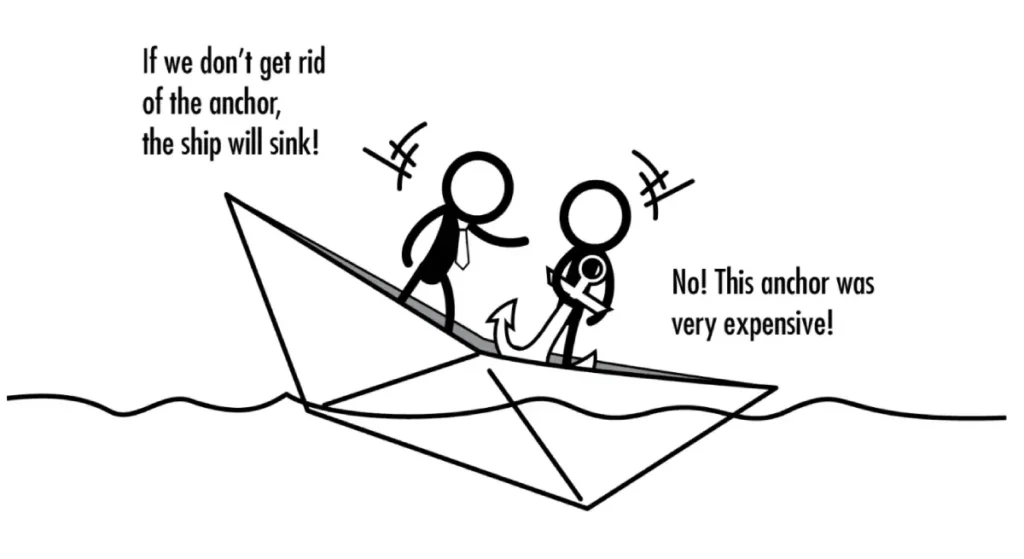

The sunk cost fallacy can trap you in a cycle of throwing good money after bad, but recognizing it gives you the power to take control. Whether you decide to continue with FBABB or cut your losses, let your choice be guided by future potential, not past investments.

Remember, you’re not alone in this. Our community is here to offer support, share experiences, and help you navigate the next steps. If you’re struggling to decide what’s best for you, don’t hesitate to reach out—we’re in this together.