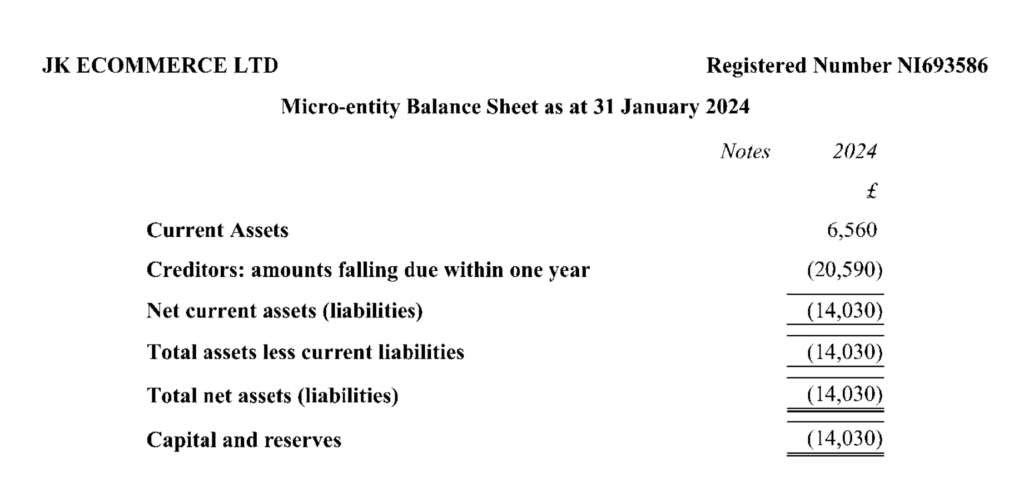

The FBA Brand Builder program, hyped as a ticket to Amazon success, is under fire—not just for its steep price tag but for the inexperience and questionable advice of its so-called mentors. Meet Jake Parker and Kayley Hutchison, two 23-year-olds marketed as “experts” in Darren Campbell’s high-cost FBA training. Here’s the kicker: neither of them has a track record of business success. In fact, their own venture, JK Ecommerce Ltd, reported £14,030 in net liabilities as of January 2024.

Despite their lack of achievements, they’re the ones running mentorship calls, dishing out financial advice, and even pushing participants toward risky credit card schemes.

Selling Dreams, Adding to Debt

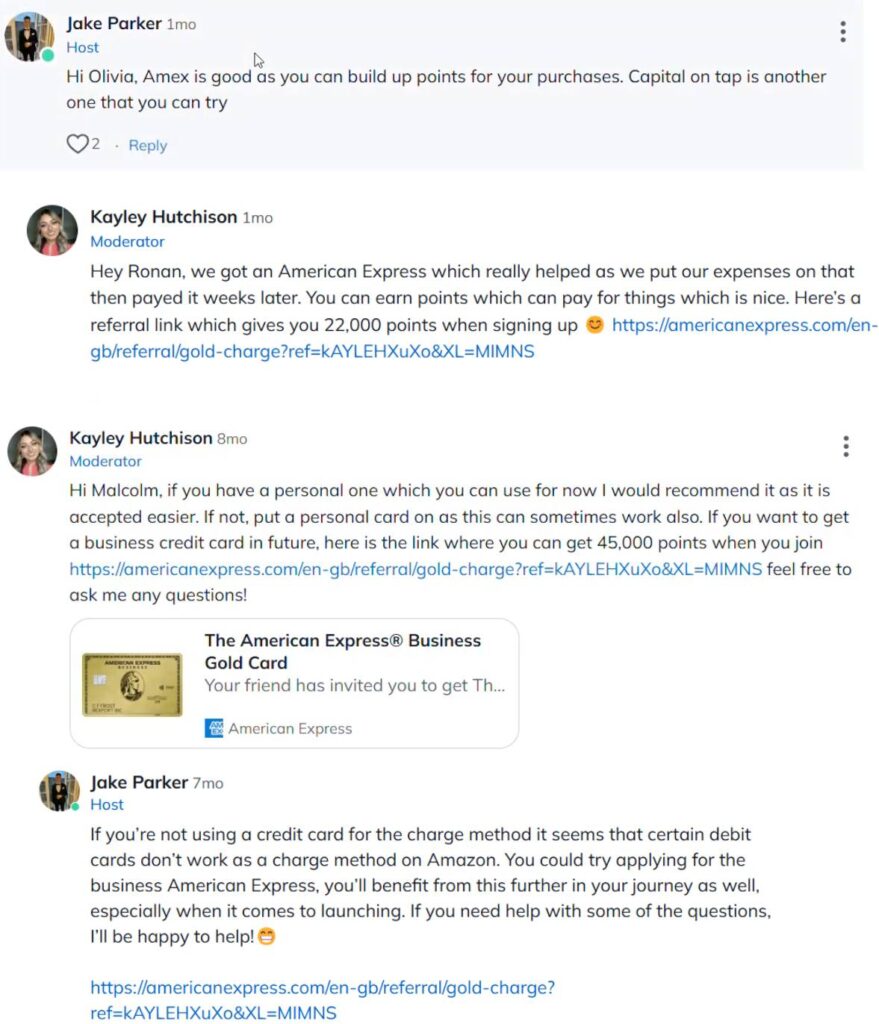

One of the most troubling patterns is the aggressive promotion of the American Express Gold Card, complete with referral links that benefit Jake and Kayley directly. For every sign-up through these links, they reportedly pocket 12,000 Membership Rewards points—a sweet deal for them but a potential financial disaster for already-struggling participants.

Here’s how it typically plays out:

- Participants are encouraged to apply for the card, no matter their financial situation.

- The supposed “business benefits” of the AMEX Gold Card are heavily emphasized, with little mention of the £195 annual fee (after the first year) or the risks of taking on more debt.

- Referral links are casually shared in mentorship chats, turning clients’ struggles into personal gains for the mentors.

For participants already burdened by the program’s £6,500 entry fee and £150/month membership costs, this advice has pushed some into spiraling debt.

Reckless Advice Beyond Credit Cards

Unfortunately, the AMEX hustle is just one example of the dubious guidance Jake and Kayley provide. Here’s a snapshot of some of their worst advice:

1. Falsifying Supplier Quotes

In one mentorship session, Kayley told participants to manipulate supplier quotes to negotiate better deals:

This advice, which flirts with fraud, could destroy supplier relationships and land participants in legal hot water. It’s unethical, risky, and completely unnecessary.

2. Inflating Revenue for Credit Applications

Participants have also been instructed to exaggerate their revenue—sometimes to £120,000—when applying for credit cards or loans, even if they’re earning far less. This is outright financial misrepresentation and could lead to fraud investigations or credit rejections.

3. Misleading W-8BEN-E Form Guidance

Jake and Kayley have repeatedly given incorrect advice on how to complete the W-8BEN-E form, a tax document crucial for non-US sellers on Amazon. Their guidance has caused account delays and even freezes, costing participants time and income.

4. Recommending “Private Foundations” for Sellers

In one of the most bizarre pieces of advice, they suggested registering as a private foundation to streamline Amazon account setup. Not only is this unnecessary, but it also creates compliance and tax risks for participants unfamiliar with the legal implications.

The Human Cost of Poor Mentorship

While Jake and Kayley profit from referral bonuses and churn out misguided advice, the damage to participants is undeniable:

- Mounting Debt: Many clients, already stretched thin from program fees, have taken on additional loans or credit card debt they can’t afford.

- Broken Relationships: Financial stress has led to family arguments, breakups, and even domestic abuse cases.

- Missed Milestones: Participants report not being able to afford birthdays, holidays, or even basic gifts after pouring their money into the program.

Why Are They Leading Mentorship Calls?

The real question is how Jake and Kayley became mentors in the first place. With no business successes to their name and their own company in financial trouble, what makes them qualified to guide others?

One theory? Darren Campbell brought them on board not for their expertise but to help them recover from their own failed FBA venture. As mentors, they’ve turned to promoting credit cards and other upsells to pad their earnings—a move that benefits them but devastates their clients.

The Bigger Picture: A Broken System

Jake and Kayley’s behavior is part of a larger pattern within the FBA Brand Builder program. Darren Campbell’s team has built a system on hype, upsells, and vague promises while ignoring the real needs of participants.

Here’s what’s driving the complaints:

- Minimal Transparency: Key decisions, like product selection, are controlled by Darren’s team using proprietary software, leaving participants in the dark.

- High-Pressure Sales Tactics: Participants are rushed into paying the program’s hefty fees under the guise of “limited spots.”

- Unqualified Mentors: The reliance on Jake and Kayley underscores a lack of real expertise in the program.

Misrepresentation and Legal Ramifications

Under UK law, Darren’s program could be skating on thin ice. The Consumer Rights Act 2015 requires services to be delivered with “reasonable care and skill.” Encouraging unethical practices, giving incorrect advice, and promoting risky financial decisions likely fail this standard.

Additionally, the Misrepresentation Act 1967 protects consumers who were lured into contracts under false pretenses. If participants were promised expert mentorship but received advice from underqualified individuals, they may have legal grounds to challenge their contracts.

Beware Taking Advice From Inexperienced Mentors

The FBA Brand Builder promises transformation and financial freedom, but the reality is far from glamorous. Inexperienced mentors, reckless advice, and questionable tactics have left many participants worse off than when they started.

If you’re considering this program—or already struggling in it—ask yourself:

- Are the mentors truly qualified to guide you?

- Is the advice you’re receiving ethical, practical, and tailored to your success?

- Are they profiting from your vulnerability?

For most, the answers are clear. Until Darren Campbell’s team takes accountability for the damage caused by their mentorship, the FBA Brand Builder will remain a warning for anyone hoping to achieve e-commerce success.

We don’t know about you, but we wouldn’t take financial advice from anyone who’s barely out of university—they simply don’t have the real-world experience to steer you right.